Mar. 5, 2026

New Tax Break Gives Seniors Up to $6,000 Back

Here's who qualifies for the enhanced senior deduction on 2025 tax returns

Mar. 5, 2026

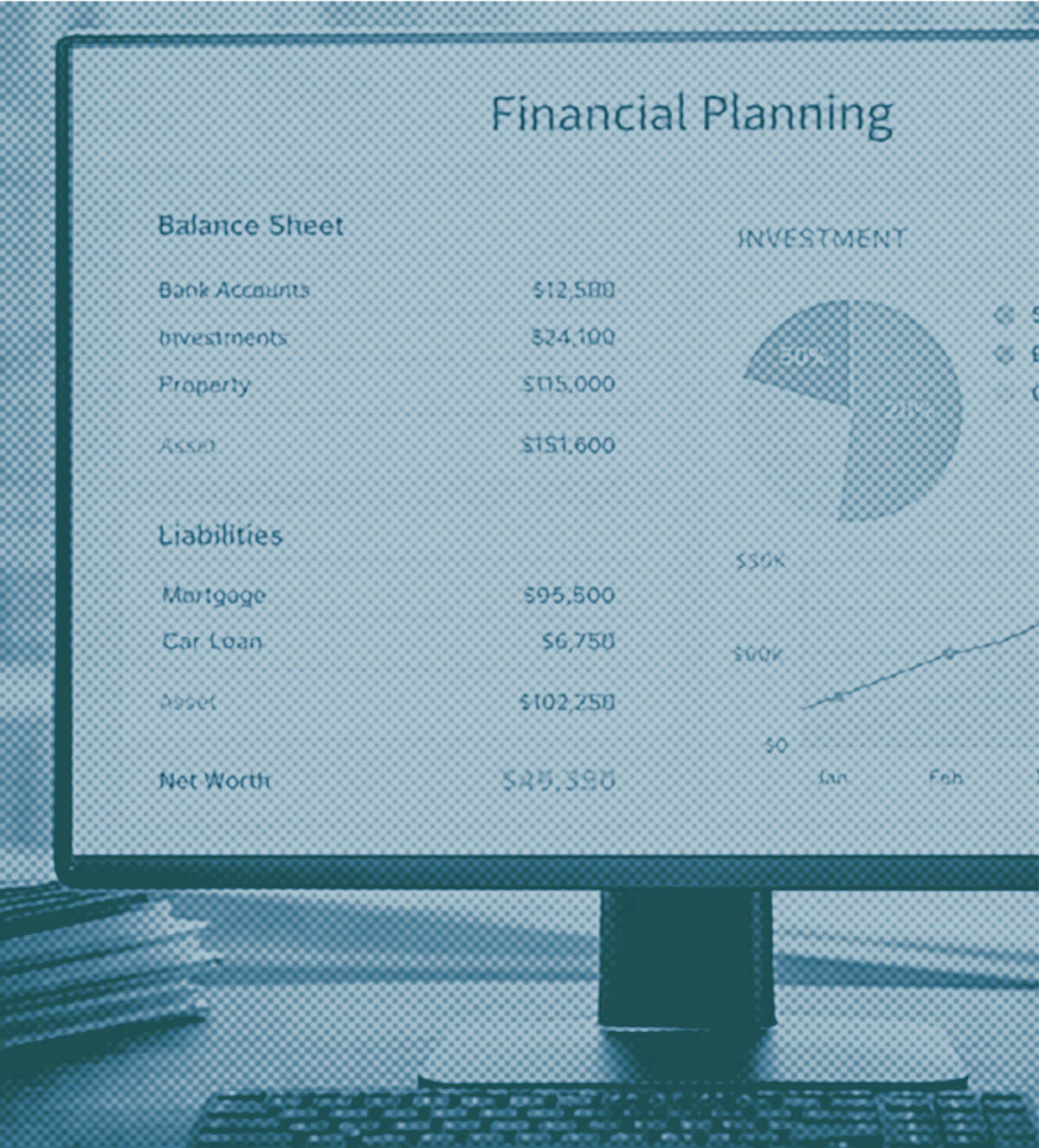

Taxes, Insurance Eat Up 21% of Mortgage Payments

Rising property taxes and insurance costs are surprising many homeowners and first-time buyers, sharply increasing monthly mortgage costs.

Mar. 5, 2026

Tax Season Tip: Fund an IRA Before It's Too Late

Contributions to a traditional IRA can lower your tax bill and boost your retirement savings.

Mar. 5, 2026

North Carolina Tax Refunds to Start Week of March 9

NCDOR says 2025 returns are now being processed, encourages e-filing for faster refunds

Mar. 4, 2026

Bigger Tax Refunds Prompt Advice on Smart Money Moves

Financial experts recommend using unexpected refund money to pay down debt and boost savings.

Mar. 3, 2026

State Residency Trackers: The Missing Tool for Low-Tax Moves

Apps like Flamingo Compliance help document your whereabouts during a transition year to a low-tax state

Mar. 3, 2026

San Diego County Property Tax Auction Nears Registration Deadline

The annual online auction features 686 properties and could generate over $18 million in revenue for the county.

Mar. 2, 2026

How to File Your Taxes for Free Through the IRS

The IRS offers free tax filing options for those who made less than $89,000 last year.

Mar. 2, 2026

Philadelphia Offers Free Tax Filing for Qualifying Individuals, Businesses

The city's Department of Revenue announced expanded free tax preparation services.

Feb. 27, 2026

Some states plan to tax Trump accounts for kids despite federal benefits

Trump accounts offer federal tax advantages, but several states intend to tax the earnings annually.

Feb. 27, 2026

Lansing Street Advisors Reduces Stake in Vanguard Tax-Exempt Bond ETF

The institutional investor sold over 11,000 shares of the municipal bond ETF in the third quarter.

Feb. 26, 2026

AICPA Seeks IRS Guidance on Trump Accounts and Tax Provisions

Accounting group requests clarity on newborn savings program and other aspects of recent tax legislation

Feb. 26, 2026

Wills, Trusts & Estates Attorney Highlights Strategies to Avoid New York Estate Tax 'Cliff'

Michael P. Enea of Enea, Scanlan & Sirignano, LLP shares planning tips to preserve family wealth

Feb. 25, 2026

Student Loan Forgiveness Taxable Again in 2026

Borrowers expecting relief could face major IRS tax bills next year.

Feb. 25, 2026

IRS Proposes New Rules on Foreign Government Investments

Officials say existing investments won't be impacted when regulations are finalized.

Feb. 25, 2026

New York City Proposes 10% Property Tax Hike to Cover Budget Shortfall

Commercial real estate owners urged to explore tax reduction strategies as city seeks new revenue sources

Feb. 23, 2026

New Tax Deductions Boost Refunds for Tipped Workers, Overtime Earners, and Seniors

The 'Big Beautiful Bill' expands deductions for several groups of taxpayers, leading to bigger tax refunds this season.

Feb. 23, 2026

IRS Reports 14% Increase in Early Tax Refunds

Average refund amount rises to $2,476 as of February 13, 2026

Feb. 23, 2026

Student Loan Forgiveness Triggers Hefty Tax Bills in 2026

Borrowers must plan ahead as forgiven debt may be considered taxable income.

Feb. 23, 2026

Crowdfunding Gifts Mistakenly Taxed as Income

Mutual aid funds received through online platforms may be incorrectly reported as taxable income.