- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Metropolis Today

By the People, for the People

Solstice Advanced Mat Reports Q4 and Full-Year 2025 Results

Highlights include momentum in nuclear energy, AI, and data centers, as well as near-term margin headwinds from refrigerants transition.

Published on Feb. 11, 2026

Got story updates? Submit your updates here. ›

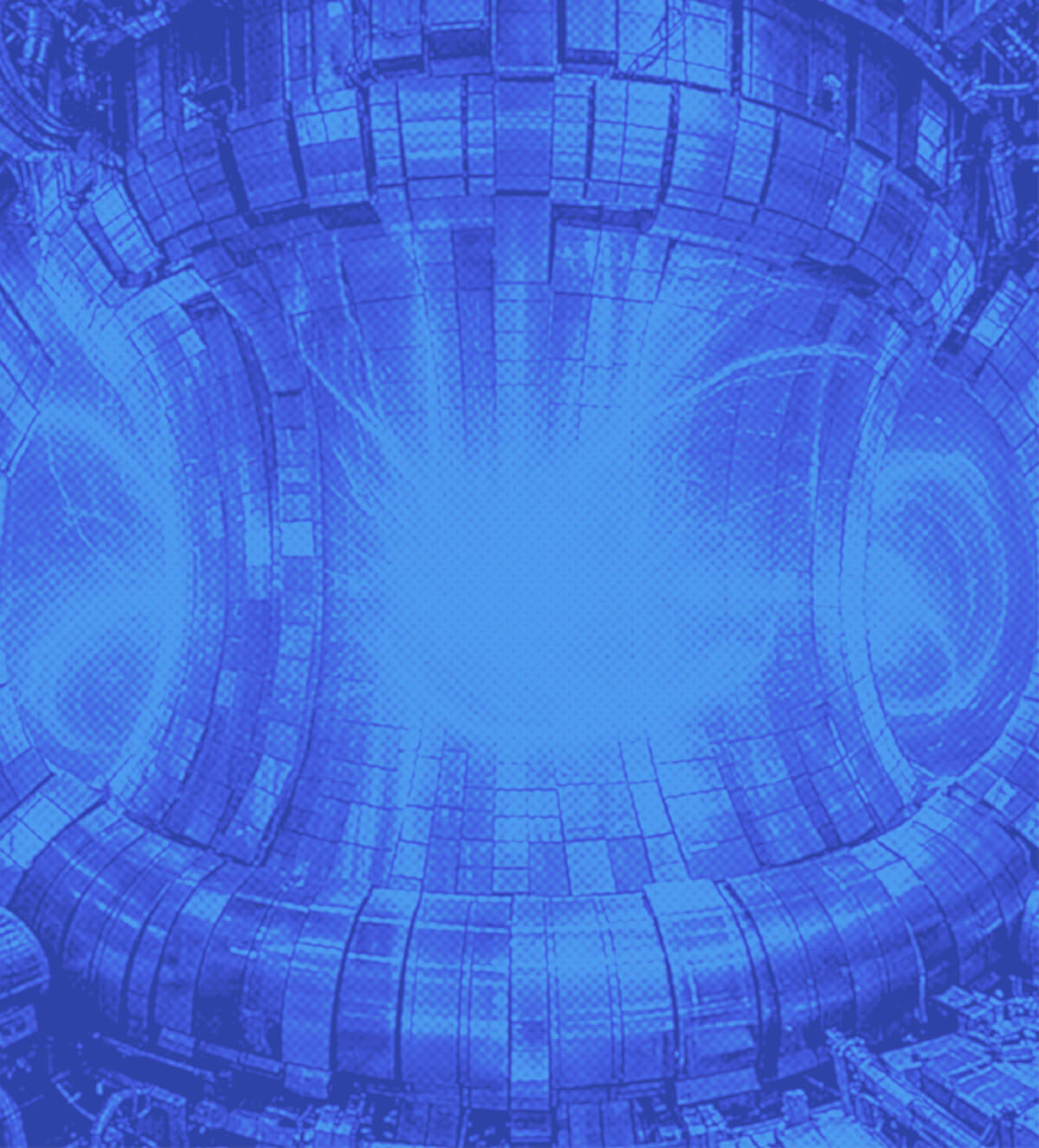

Solstice Advanced Materials, a leading global specialty materials company, reported its fourth-quarter and full-year 2025 results, marking the company's first earnings call since its spin-off from Honeywell in October 2025. Executives highlighted strong performance in end markets tied to nuclear energy, AI, data centers, and defense, while also outlining near-term margin pressures from the ongoing refrigerants transition and separation-related costs.

Why it matters

Solstice's results provide insight into the company's positioning and growth prospects following its separation from Honeywell. The performance in key end markets like nuclear energy, semiconductors, and data centers suggests Solstice is well-positioned in high-growth technology and infrastructure sectors, while the refrigerants transition highlights the challenges the company faces in managing product mix shifts.

The details

In the fourth quarter, Solstice reported net sales of $987 million, up 8% year-over-year, driven by 6% organic growth and 2% from foreign currency translation. Adjusted standalone EBITDA was $189 million, down 20% due to transitory costs, the refrigerants transition, and planned plant downtime. For the full year 2025, Solstice reported net sales of $3.9 billion, up 3%, and adjusted EBITDA of $957 million, down 4%. The company cited higher capital expenditures of $408 million, up 38%, as it invested in growth projects. Segment performance was mixed, with strength in nuclear and electronic materials offset by margin pressure in refrigerants and building solutions.

- Solstice completed its spin-off from Honeywell on October 30, 2025.

- Solstice reported its Q4 and full-year 2025 results on February 11, 2026.

The players

Solstice Advanced Materials

A leading global specialty materials company that advances science for smarter outcomes, offering high-performance solutions for critical industries and applications.

Tina Pierce

Chief Financial Officer of Solstice Advanced Materials.

David Sewell

Chief Executive Officer of Solstice Advanced Materials.

What they’re saying

“Solstice's Metropolis Works facility is the only UF6 conversion site in the United States, and the company expects to increase production in 2026 by about 20% over planned 2024 capacity, targeting more than 10 KT of production.”

— David Sewell, CEO

“We expect 'low- to mid-single-digit' nuclear growth in 2026, and reiterated expectations for double-digit EBITDA growth CAGR through 2030 based on current backlog and production levels.”

— David Sewell, CEO

What’s next

Solstice plans to host a webinar later in 2026 focused on its nuclear business to provide more details on its growth plans and capacity expansion efforts.

The takeaway

Solstice's strong performance in high-growth end markets like nuclear energy, semiconductors, and data centers demonstrates its ability to capitalize on emerging technology and infrastructure trends, though the company must navigate near-term headwinds from the refrigerants transition. The initiation of a dividend and focus on capital allocation suggest Solstice is positioning itself for long-term sustainable growth as an independent specialty materials leader.