- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Big Week for Economic News, Q4 Earnings Reports

Earnings season continues with many marquee names reporting this week, while key economic data is also on tap.

Published on Feb. 9, 2026

Got story updates? Submit your updates here. ›

This week is set to be a busy one for the markets, with a slew of Q4 earnings reports from major companies as well as important economic data releases. Earnings season has already seen many of its marquee names report, but the sheer number of companies reporting increases this week. Additionally, key economic reports like the Consumer Price Index, Retail Sales, and the NFIB Small Business Optimism survey are all expected this week, providing a clearer picture of the overall economy.

Why it matters

Investors will be closely watching this week's earnings reports and economic data to gauge the health of the US economy and the performance of major companies. The information from these reports can impact market sentiment and influence investment decisions.

The details

Pre-market futures are slightly down on Monday morning, with the Dow, S&P 500, and Nasdaq all trading lower. However, the small-cap Russell 2000 is trading flat. Key earnings reports this week include steel producer Cleveland-Cliffs, which beat Q4 earnings expectations but missed on revenue, and Sally Beauty, which had mixed results. On the economic front, Friday's Consumer Price Index report for January is highly anticipated, with expectations of 0.3% growth in both headline and core CPI, and a 2.5% year-over-year inflation rate. Other key economic data releases this week include Import and Export Prices, Retail Sales, the NFIB Small Business Optimism survey, and weekly jobless claims.

- The Consumer Price Index report for January will be released on Friday morning.

- Import and Export Prices, Retail Sales, and the NFIB Small Business Optimism survey are all expected to be released on Tuesday.

- Weekly Jobless Claims data will be released on Thursday morning.

The players

NVIDIA

A Zacks Rank #2 (Buy)-rated chipmaker that is expected to report stellar growth numbers, with +70.8% earnings growth and +66.7% revenue growth year-over-year, in its earnings report two weeks from Wednesday.

ClevelandCliffs

A steel-producing major that outperformed on its Q4 bottom line, reporting -$0.43 per share versus expectations for -$0.62, for a +30.65% earnings surprise, though its revenues of $4.31 billion in the quarter missed consensus by -6.7%.

Sally Beauty

A beauty retailer that reported mixed fiscal Q1 results, beating on earnings by a penny to 48 cents per share on $943.17 million in revenues, which was a hair light (-0.08%) of estimates.

What’s next

The judge in the case will decide on Tuesday whether or not to allow Walker Reed Quinn out on bail.

The takeaway

This week's earnings reports and economic data releases will provide valuable insights into the overall health of the US economy and the performance of major companies. Investors will be closely watching these developments to inform their investment decisions.

Cleveland top stories

Cleveland events

Mar. 6, 2026

Led Zeppelin 2Mar. 6, 2026

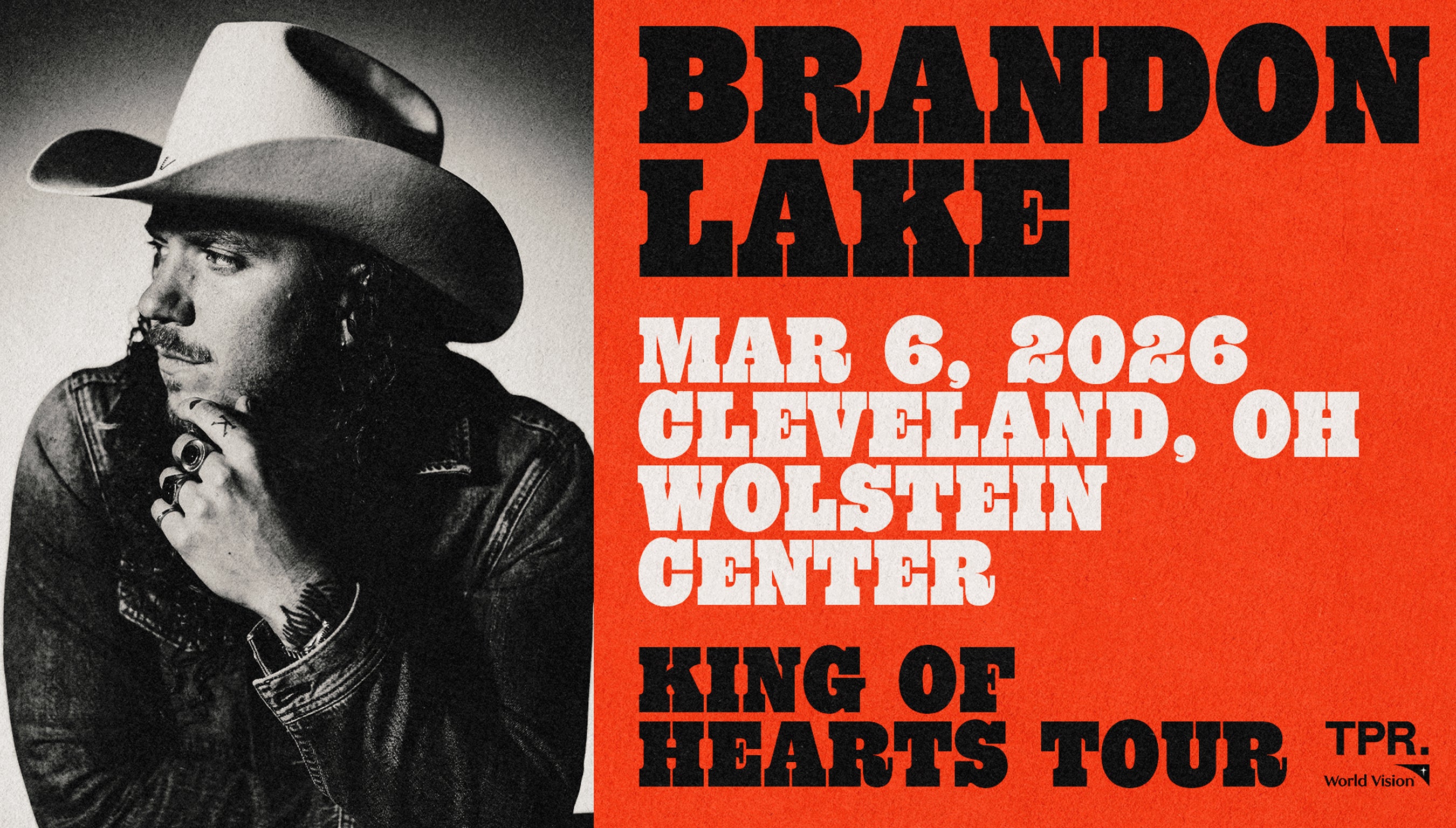

Brandon Lake - King of Hearts TourMar. 6, 2026

Brandon Lake Ticket + Hotel Deals