- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

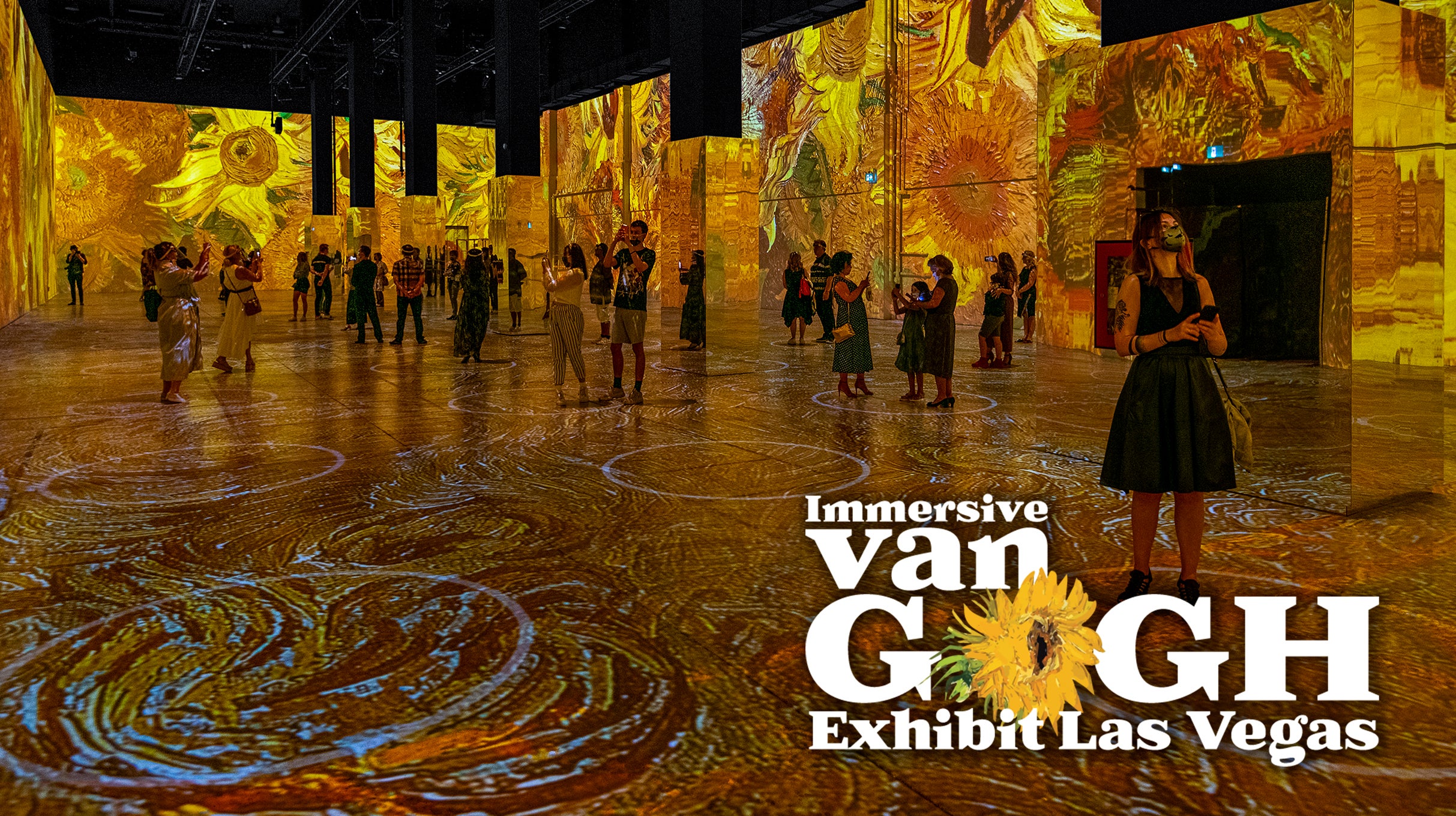

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Las Vegas Cleaning Company Owner Pleads Guilty to Tax Crimes

Deborah Meadows admits to failing to pay over $1.2 million in employment taxes for more than a decade

Published on Feb. 13, 2026

Got story updates? Submit your updates here. ›

Deborah Meadows, the former owner of a Las Vegas cleaning company called A to Z Employment Services LLC, has pleaded guilty in federal court to employment tax crimes. Meadows admitted that from 2010 to 2020, she withheld payroll taxes from employee paychecks but failed to remit those funds to the Internal Revenue Service, resulting in over $1.2 million in tax losses. She also submitted altered financial documents to investigators in an attempt to mislead them about the company's tax obligations.

Why it matters

Employment tax violations like this case are a serious federal offense, as the withheld funds are considered 'trust fund' taxes that employers are legally required to hold and remit to the government. When employers misuse these funds, it impacts both employees who lose credit for their Social Security and Medicare contributions, as well as taxpayers who ultimately bear the financial burden. The case highlights the federal government's ongoing efforts to crack down on payroll tax violations by business owners.

The details

According to court records, Deborah Meadows, 64, operated a cleaning, carpet, and upholstery business serving the Las Vegas area. From 2010 through 2020, she collected Social Security, Medicare, and federal income taxes from employee paychecks but failed to send those funds to the IRS. Prosecutors stated that the unpaid employment taxes exceeded $1.2 million. In addition, Meadows did not file the required quarterly employment tax returns during that period and also failed to file her personal federal income tax returns for multiple years between 2018 and 2021.

- From early 2010 through the end of 2020, Meadows withheld payroll taxes from employee paychecks but did not remit them to the IRS.

- After the IRS began examining the company's tax filings, Meadows submitted altered financial documents in response to a grand jury subpoena in an attempt to mislead investigators.

- Meadows pleaded guilty in federal court in February 2026.

- Sentencing is scheduled for May 21, 2026.

The players

Deborah Meadows

The 64-year-old former owner of A to Z Employment Services LLC, a cleaning, carpet, and upholstery business serving the Las Vegas area.

A to Z Employment Services LLC

The cleaning, carpet, and upholstery business owned by Deborah Meadows in Las Vegas.

Internal Revenue Service (IRS)

The federal agency that began examining A to Z Employment Services' tax filings and uncovered Meadows' failure to remit payroll taxes.

What’s next

The judge in the case will determine Deborah Meadows' sentence at the hearing scheduled for May 21, 2026.

The takeaway

This case highlights the serious consequences for business owners who fail to meet their payroll tax obligations, including potential prison time. It underscores the federal government's ongoing efforts to crack down on employment tax violations, which can have far-reaching impacts on employees, government programs, and taxpayers.

Las Vegas top stories

Las Vegas events

Mar. 9, 2026

Farrell Dillon Comedy MagicianMar. 9, 2026

Blue Man Group Las Vegas