- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

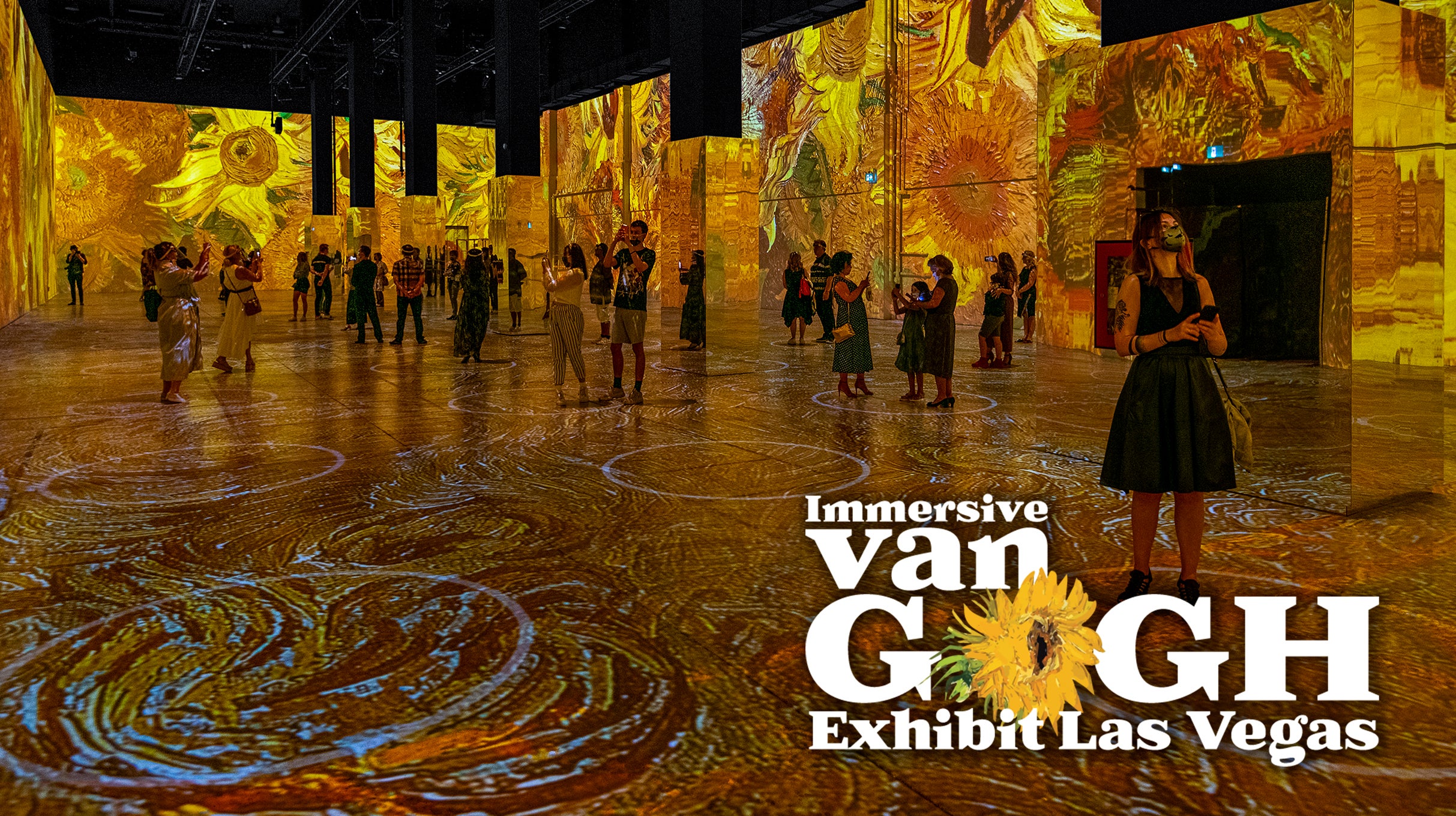

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Analyzing Agassi Sports Entertainment and OSR Holdings

Comparing the performance and outlook of two small-cap retail/wholesale companies

Published on Feb. 11, 2026

Got story updates? Submit your updates here. ›

Agassi Sports Entertainment (OTCMKTS:AASP) and OSR Holdings (NASDAQ:OSRH) are both small-cap retail/wholesale companies, but which one is the superior business? This article compares the two companies based on factors like profitability, dividends, risk, analyst recommendations, institutional ownership, valuation, and earnings.

Why it matters

Analyzing and comparing the performance of small-cap companies in the retail/wholesale sector can provide insights into industry trends, competitive dynamics, and investment opportunities for investors looking to diversify their portfolios.

The details

The analysis found that OSR Holdings has a higher beta of 1.41, indicating its stock price is 41% more volatile than the S&P 500, while Agassi Sports Entertainment has a lower beta of 0.76, suggesting its stock is 24% less volatile. In terms of valuation, Agassi Sports Entertainment is trading at a lower price-to-earnings ratio than OSR Holdings, making it the more affordable of the two stocks currently. The analysis also looked at metrics like net margins, return on equity, and return on assets, as well as current recommendations and price targets from analysts.

- The analysis was published on February 11, 2026.

The players

Agassi Sports Entertainment

A small-cap retail/wholesale company trading on the OTCMKTS under the ticker AASP.

OSR Holdings

A small-cap retail/wholesale company trading on the NASDAQ under the ticker OSRH.

Global Acquisitions Corporation

Previously involved in operating a golf center, the company now intends to seek, investigate, and acquire an interest in new business opportunities.

OSR Holdings

A company that leverages its international network of partners to market and license its pipeline of proprietary platform technologies, with the goal of addressing unmet medical needs.

The takeaway

This analysis highlights the importance of carefully evaluating the relative performance and outlook of small-cap companies in the retail/wholesale sector, as factors like volatility, valuation, and financial metrics can vary significantly between competitors and impact investment decisions.

Las Vegas top stories

Las Vegas events

Mar. 9, 2026

Farrell Dillon Comedy MagicianMar. 9, 2026

Blue Man Group Las Vegas