- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Warren Buffett Shares Timeless Investing Advice for Volatile Markets

The 'Oracle of Omaha' emphasizes patience, quality businesses, and emotional discipline to weather market ups and downs.

Published on Feb. 9, 2026

Got story updates? Submit your updates here. ›

Warren Buffett, the legendary investor and chairman of Berkshire Hathaway, has spent decades sharing his financial wisdom and offering perspective during periods of market volatility. His approach centers on investing in companies with strong performance and durable advantages, maintaining cash reserves for flexibility, and focusing on long-term business fundamentals rather than short-term price movements.

Why it matters

Buffett's investing philosophy provides a timeless playbook for individual investors navigating uncertain markets. His lessons on controlling emotions, identifying quality businesses, and deploying capital strategically can help guide investment decisions and lead to positive financial outcomes, even in volatile times.

The details

Buffett emphasizes that investing in companies with strong fundamentals, pricing power, and management quality is more important than chasing short-term price movements. He has maintained long-term stakes in businesses like Coca-Cola, demonstrating the value of patience and confidence in well-run enterprises. Buffett also advises being 'greedy when others are fearful,' using cash reserves to capitalize on market downturns and buy quality assets at discounted prices. Additionally, he cautions against getting distracted by media noise and instead staying focused on a company's long-term performance.

- In 1969, Buffett wrote a letter to his partners emphasizing that he thinks of stocks as businesses, not just ticker symbols.

- In Berkshire Hathaway's 2008 shareholder letter, Buffett highlighted the company's 'Gibraltar-like financial position' and 'huge amounts of excess liquidity' as strengths during the financial crisis.

- In his 1988 letter to shareholders, Buffett explained that Berkshire is 'just the opposite of those who hurry to sell and book profits when companies perform well.'

The players

Warren Buffett

The chairman and CEO of Berkshire Hathaway Inc., one of the world's most respected investors known as the 'Oracle of Omaha' for his long-term, value-oriented investment approach.

Berkshire Hathaway Inc.

A multinational conglomerate holding company that Buffett has chaired since 1970, known for its patient, long-term investment strategy and ownership of a diverse range of subsidiaries.

Coca-Cola Co.

A global beverage company in which Berkshire Hathaway has maintained a significant ownership stake since 1988, demonstrating Buffett's commitment to holding quality businesses for the long term.

What they’re saying

“You should be unconcerned about short-term price action when you own the securities directly … I think about them as businesses, not stocks, and if the business does all right over the long term, so will the stock.”

— Warren Buffett (1969 letter to partners)

“Berkshire is always a buyer of both businesses and securities, and the disarray in markets gave us a tail wind in our purchases.”

— Warren Buffett (Berkshire Hathaway 2008 shareholder letter)

“We are just the opposite of those who hurry to sell and book profits when companies perform well.”

— Warren Buffett (1988 letter to shareholders)

The takeaway

Buffett's timeless investing advice emphasizes the importance of patience, emotional discipline, and a focus on the long-term fundamentals of quality businesses. By emulating his approach of buying and holding great companies, individual investors can navigate volatile markets and potentially achieve positive financial outcomes over time.

Omaha top stories

Omaha events

Mar. 9, 2026

Peter McPolandMar. 9, 2026

TotoMar. 11, 2026

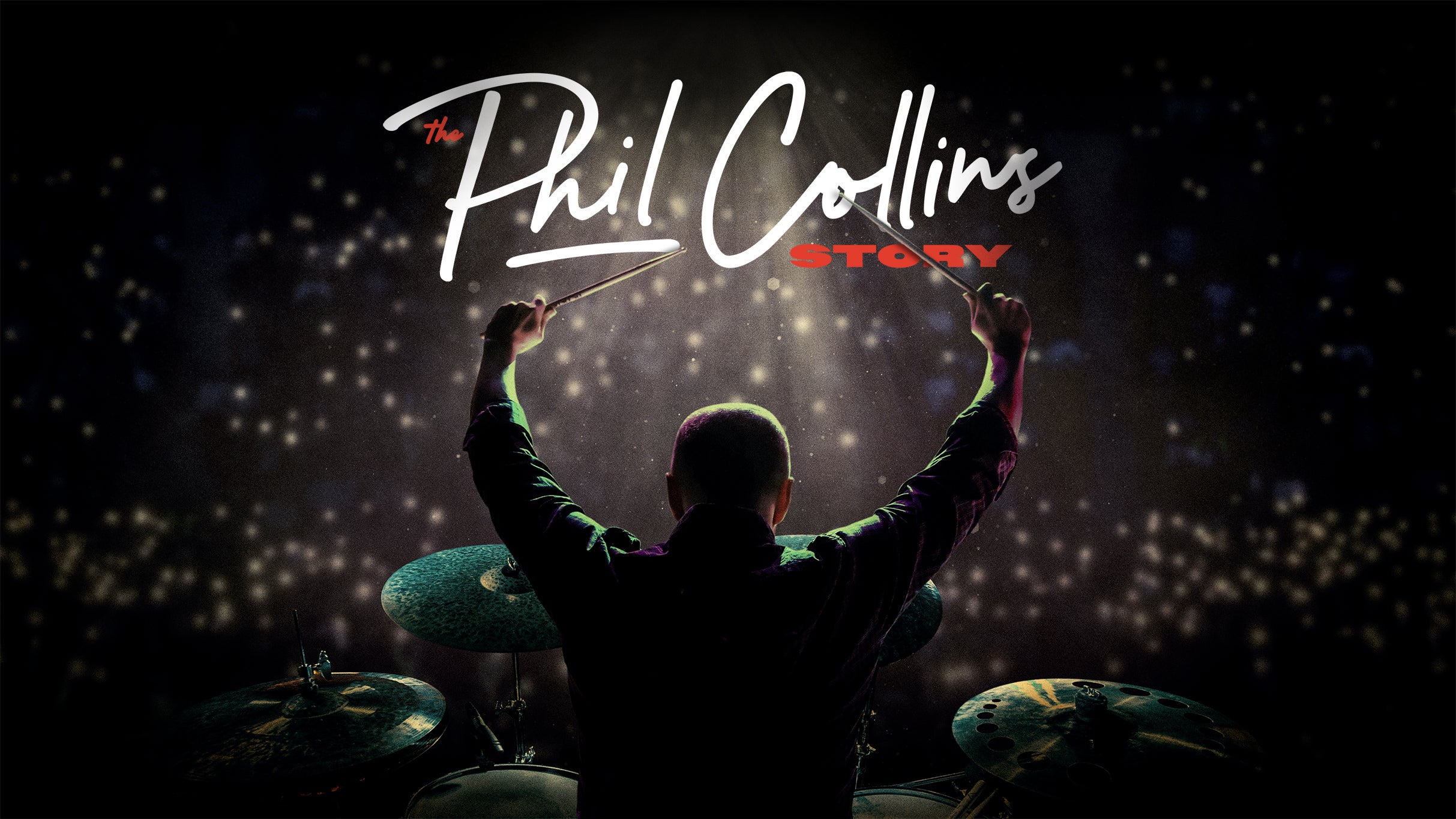

In The Air Tonight: The Phil Collins Story