- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

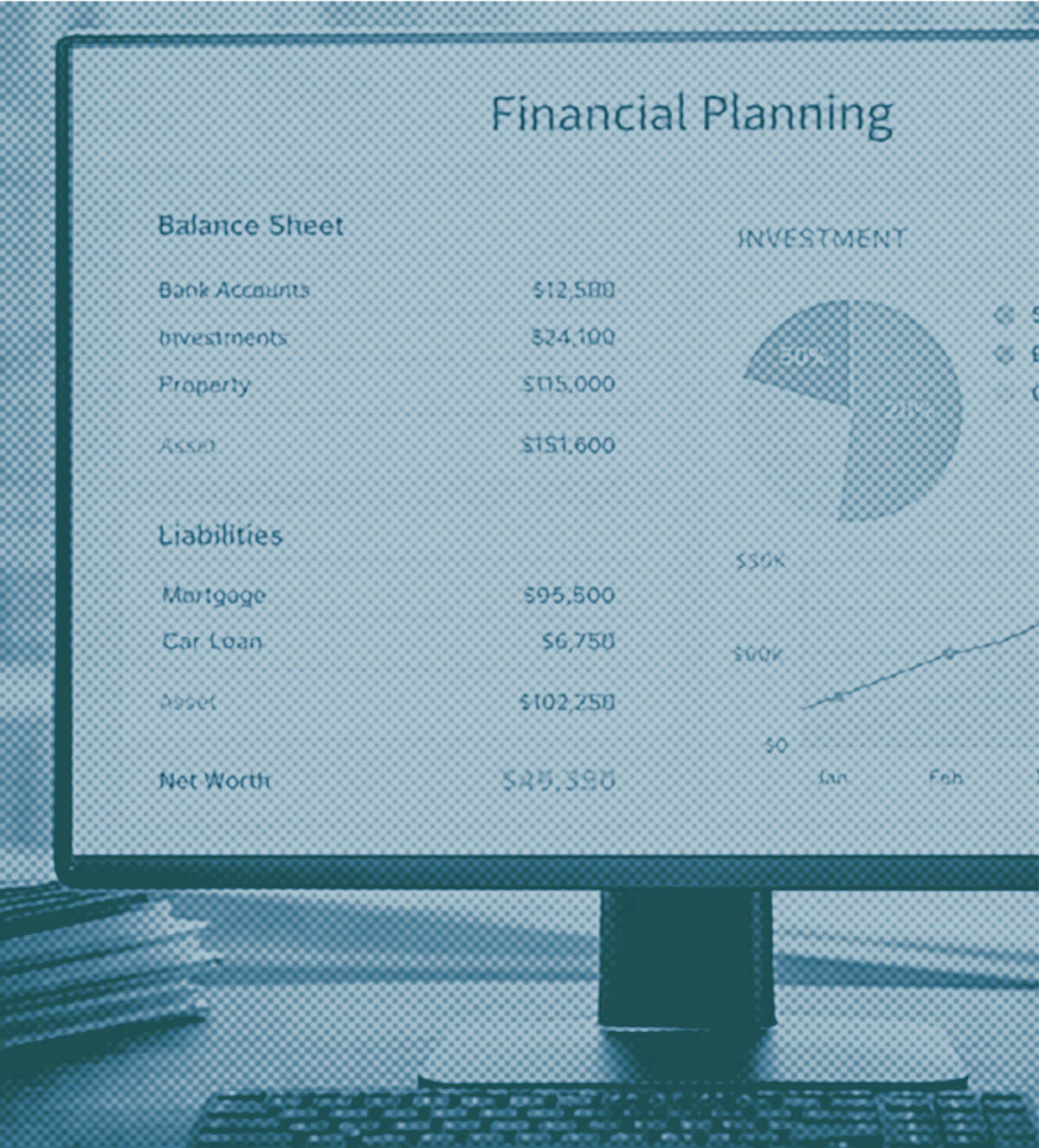

BX Partners Launches 12 Open-Architecture Portfolio Models on Nitrogen Partner Store

The BX models provide financial advisors with access to nonproprietary stock-and-ETF portfolios designed to align with client risk profiles.

Published on Feb. 18, 2026

Got story updates? Submit your updates here. ›

BX Partners, an investment consulting platform, has announced the launch of 12 open-architecture portfolio models on the Nitrogen Partner Store. The BX models are designed to provide financial advisors with access to nonproprietary stock-and-ETF portfolios that align with client risk profiles and deliver risk-adjusted performance.

Why it matters

The inclusion of stock-and-ETF blended models is a unique offering within the Nitrogen Partner Store, as it helps advisors demonstrate objectivity, reduce product-driven conflicts of interest, and often improve cost and fit for clients compared to proprietary fund/ETF lineups. This can lead to broader diversification tools, potential access to lower-cost or more specialized ETFs, and a clearer story about how products were chosen for end investors.

The details

The BX models are available directly within subscribing advisors' Nitrogen accounts and span four risk levels: moderately conservative, moderate, moderately aggressive, and aggressive, across three distinct portfolio structures - global models using ETFs and individual stocks, U.S.-only models using ETFs and individual stocks, and ETF-only U.S. models. The models are designed to integrate into advisor workflows without overlay fees, separately managed account fees, or third-party asset management charges, with advisors paying only the underlying ETF expense ratios passed through to clients.

- The BX models were launched on February 17, 2026.

The players

BX Partners

An investment consulting platform that supports financial professionals in building institutional-quality models with the goal of enhancing existing internal asset management platforms.

Nitrogen

An industry leader providing AI-enabled, client-facing software for financial advisors, with an integrated platform that combines risk alignment, investment planning, tax planning, retirement planning, and proposal generation.

Craig Cmiel

The co-founder of BX Partners.

What they’re saying

“The BX open-architecture models are built to work with Nitrogen, not around it. It's innovative and the strategies are very effective. They also reflect what makes BX different. We're not a money manager, we're a model builder. We have a very friendly ecosystem and everything we built for these models is for the Nitrogen user.”

— Craig Cmiel, Co-founder, BX Partners (BusinessWire)

“Our models dial directly into Nitrogen's scoring system. They're developed for risk management and behavioral alignment, not emotional decision-making. That makes them practical, usable tools advisors can use in real client situations.”

— Craig Cmiel, Co-founder, BX Partners (BusinessWire)

What’s next

Advisors can access the full BX model suite directly through the BX tile on the Nitrogen Partner Store. More information is available at BXIndex.com/Nitrogen.

The takeaway

The launch of BX Partners' open-architecture portfolio models on the Nitrogen Partner Store provides financial advisors with a unique opportunity to access nonproprietary, risk-aligned investment strategies that can help them better serve their clients' needs and fulfill their fiduciary duties.

Charlotte top stories

Charlotte events

Feb. 18, 2026

Ruel - Kicking My Feet TourFeb. 18, 2026

Monaleo