- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Troy Today

By the People, for the People

The Ultrawealthy's Secrets to Avoiding Taxes

From trusts to 'step-up' rules, the rich have found ways to pass on wealth with minimal tax burden.

Published on Feb. 17, 2026

Got story updates? Submit your updates here. ›

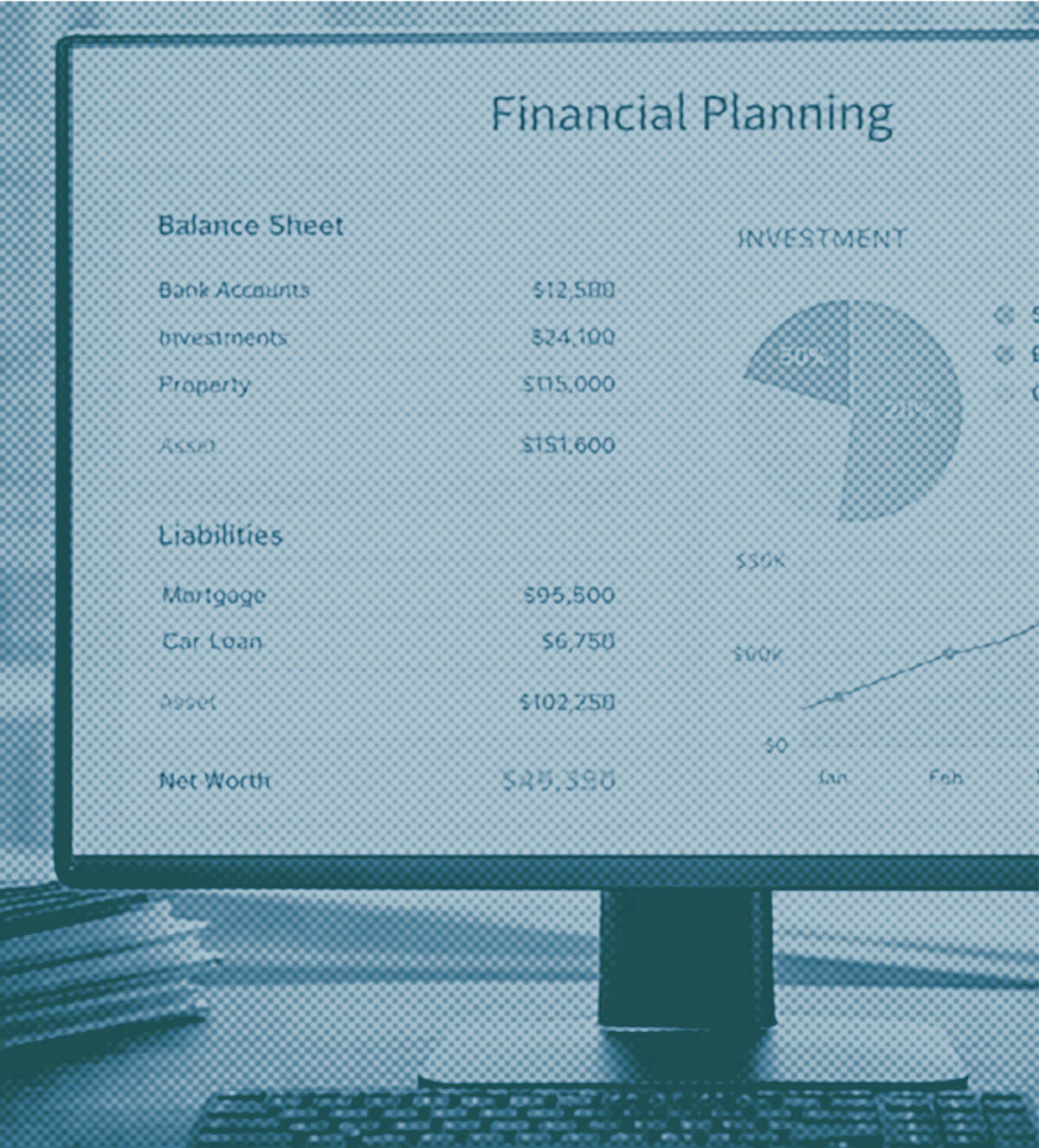

The wealthy have developed strategic methods to minimize taxes and ensure the seamless transfer of their assets to the next generation. These tactics include utilizing trusts to avoid probate fees, taking advantage of the 'step-up' rule to eliminate capital gains taxes on inherited investments, and keeping beneficiary designations up to date. While these techniques may seem like 'smoke and mirrors,' experts say they are legal and can benefit even those with more modest estates.

Why it matters

Understanding the tax-avoidance strategies used by the ultrawealthy can help inform estate planning for a wider range of individuals, allowing them to pass on their wealth more efficiently and with fewer costs. This is especially relevant as the baby boomer generation continues to transfer trillions in assets to their heirs.

The details

The key estate planning tools utilized by the wealthy include trusts, which can help avoid probate fees, and the 'step-up' rule, which allows inherited investments to be sold with little to no capital gains tax. Additionally, keeping beneficiary designations current on financial accounts is a simple way to ensure assets are transferred directly to intended recipients. While these strategies require upfront planning and legal fees, they can significantly reduce the tax burden on heirs.

- The 'step-up' rule has been in place for decades, allowing the wealthy to grow their investments tax-free until they are inherited.

- Many states and the District of Columbia collect estate or inheritance taxes, often with lower exemption thresholds than the federal level.

The players

Mark Bosler

An estate planning attorney in Troy, Michigan, and legal adviser to Real Estate Bees.

Renee Fry

The CEO of Gentreo, an online estate planner based in Quincy, Massachusetts.

Benjamin Trujillo

A partner with the wealth advisory firm Moneta, based in St. Louis, Missouri.

Allison Harrison

An attorney in Columbus, Ohio who focuses on estate planning.

What they’re saying

“It's a strategic game of chess played over decades. While the average person relies on a simple will, the well-to-do utilize a different playbook.”

— Mark Bosler, Estate planning attorney (Fortune)

“Wealth transfer looks like smoke and mirrors. Assets like stocks can quietly grow for decades and, when they're inherited, the tax bill often disappears.”

— Benjamin Trujillo, Partner, Moneta (Fortune)

“One of the easiest ways to transfer assets hassle-free.”

— Allison Harrison, Estate planning attorney (Fortune)

“Wealthy families plan. They don't leave assets and decisions unprotected.”

— Renee Fry, CEO, Gentreo (Fortune)

What’s next

Lawmakers have sometimes proposed limits on the 'step-up' rule, but for now it remains a key tool in the arsenal of those looking to create generational wealth.

The takeaway

While the tax-avoidance strategies used by the ultrawealthy may seem out of reach for the average person, understanding these techniques can help inform more accessible estate planning options. By utilizing tools like trusts and keeping beneficiary designations current, even those with more modest means can ease the transfer of their assets and minimize the tax burden on their heirs.