- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Troy Today

By the People, for the People

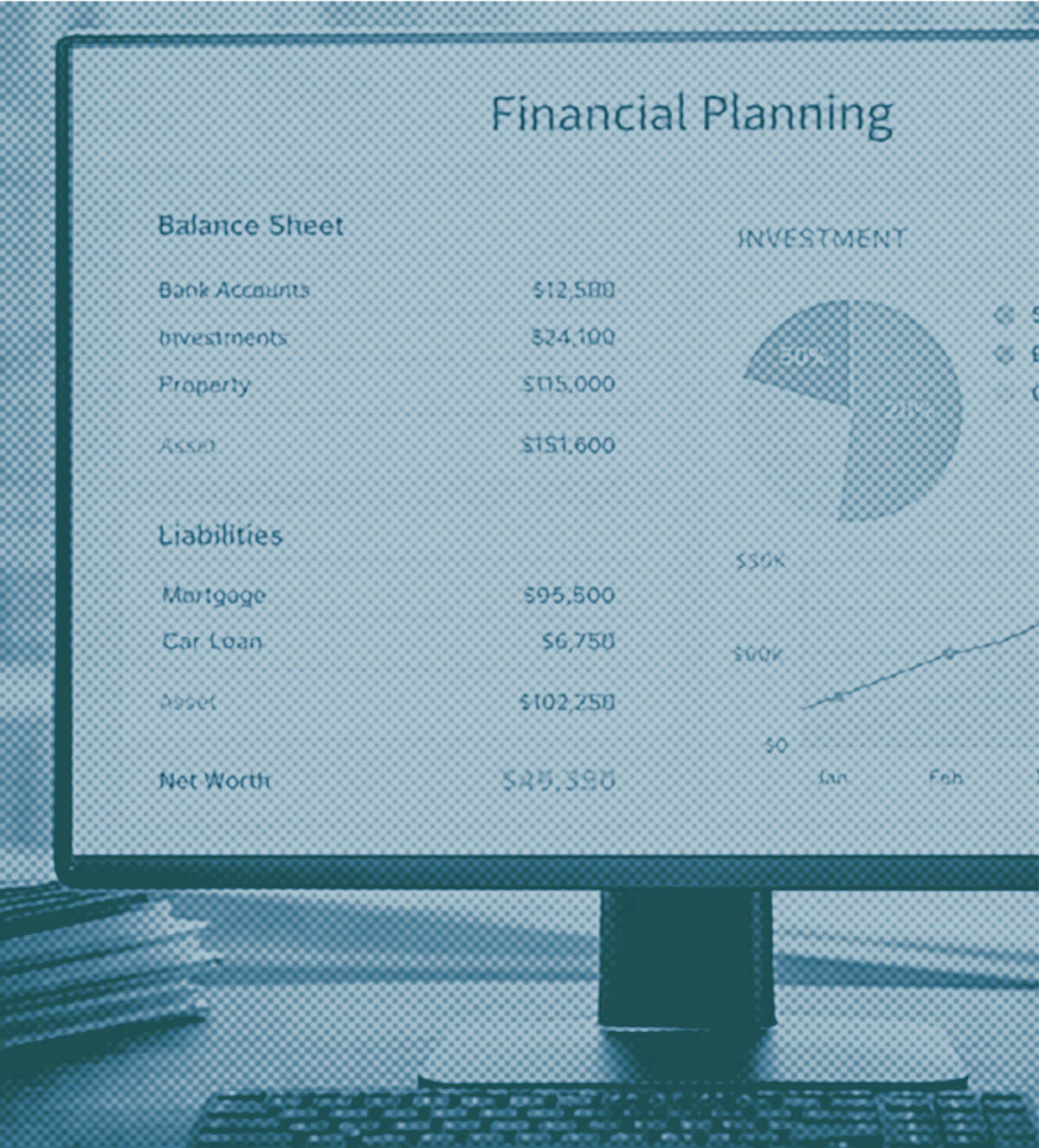

How the Rich Pass on Their Wealth - And How You Can Too

Strategies the wealthy use to avoid taxes and ensure smooth transfer of assets to heirs can also benefit those with more modest estates.

Published on Feb. 17, 2026

Got story updates? Submit your updates here. ›

The article discusses how the wealthy use various estate planning strategies, such as trusts and beneficiary designations, to efficiently pass on their wealth to the next generation and avoid taxes. It explains that these same strategies can also benefit people with more modest estates, helping them avoid the hassle and costs of the probate process.

Why it matters

Estate planning is crucial for ensuring a smooth transfer of assets to heirs, regardless of the size of one's estate. The article highlights how even those without a large estate can benefit from using tools like trusts and beneficiary designations to avoid the time and expense of probate, allowing more of their wealth to go to their intended beneficiaries.

The details

The article outlines several key estate planning strategies used by the wealthy, including trusts, which can help avoid probate and keep details of an estate private. It also discusses the 'step-up' rule, which allows heirs to avoid paying taxes on the appreciated value of inherited assets like stocks. Additionally, the article emphasizes the importance of keeping beneficiary designations up to date on financial accounts.

- The article was published on February 16, 2026.

The players

Mark Bosler

An estate planning attorney in Troy, Michigan, and legal adviser to Real Estate Bees.

Renee Fry

The CEO of Gentreo, an online estate planner based in Quincy, Massachusetts.

Benjamin Trujillo

A partner with the wealth advisory firm Moneta, based in St. Louis, Missouri.

Allison Harrison

An attorney in Columbus, Ohio who focuses on estate planning.

What they’re saying

“It's a strategic game of chess played over decades. While the average person relies on a simple will, the well-to-do utilize a different playbook.”

— Mark Bosler, Estate planning attorney

“You are leaving what might have gone to your children or other loved ones to attorneys and the courts. Anywhere from 3 to 8% of an estate might be lost.”

— Renee Fry, CEO of Gentreo

“Wealth transfer looks like smoke and mirrors. Assets like stocks can quietly grow for decades and, when they're inherited, the tax bill often disappears.”

— Benjamin Trujillo, Partner at Moneta

“One of the easiest ways to transfer assets hassle-free.”

— Allison Harrison, Estate planning attorney

What’s next

Lawmakers have sometimes proposed limits on the 'step-up' rule, but at least for now, it remains, making it one of the biggest not-so-secret weapons in the arsenals of those looking to create generational wealth.

The takeaway

Estate planning is crucial for ensuring a smooth transfer of assets to heirs, regardless of the size of one's estate. Even those without a large estate can benefit from using tools like trusts and beneficiary designations to avoid the time and expense of probate, allowing more of their wealth to go to their intended beneficiaries.