- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

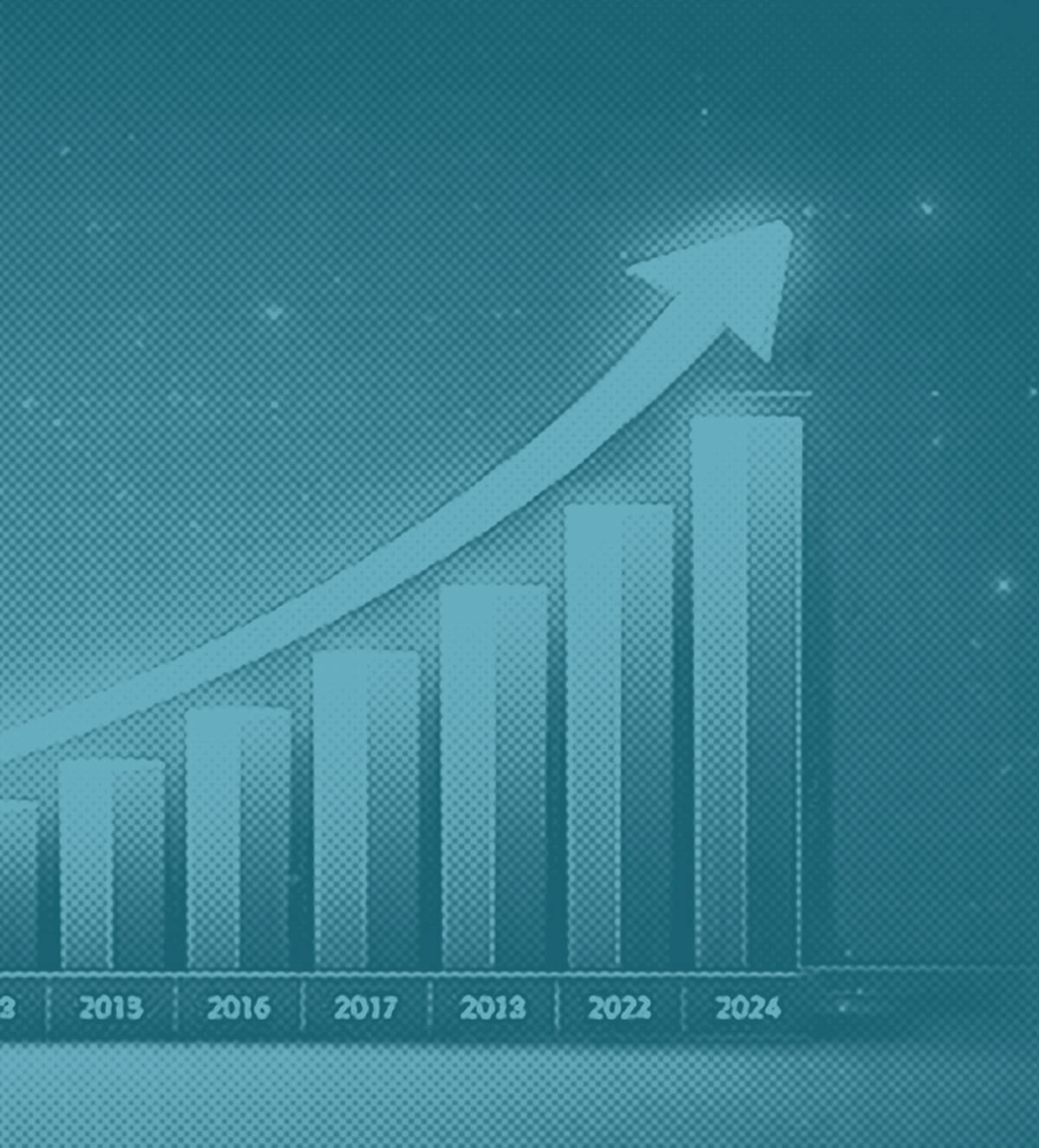

Retirees Underestimate Unexpected Expenses, Study Finds

The average retired household spends $7,100 annually on surprise costs, but many lack sufficient savings to cover even a single year.

Published on Feb. 15, 2026

Got story updates? Submit your updates here. ›

A new study by the Center for Retirement Research at Boston College found that 83% of retirees experience 'shock' expenses each year, with the average retired household spending $7,100 annually on unexpected costs across three main categories: rainy day ($3,300), healthcare ($4,100), and family-related ($5,700). However, the study showed that retirees across all income levels significantly underestimate these emergency expenditures, with many lacking sufficient cash to cover even a single year's worth of surprise costs.

Why it matters

This research highlights the importance for retirees to plan and save for unexpected expenses, as many are dangerously underprepared. Underestimating emergency costs can quickly deplete retirement savings and leave retirees vulnerable to financial hardship. Understanding the common sources of surprise expenses in retirement can help pre-retirees and retirees build adequate emergency funds to weather unexpected events.

The details

The study found that the most common sources of emergency spending for retirees fall into three main categories: 'rainy day' expenses like home or car repairs ($3,300 per year), healthcare costs such as out-of-pocket medical and dental care ($4,100 per year), and family-related expenses like helping relatives with financial needs ($5,700 per year). Across all income levels, retirees significantly underestimated their likely emergency expenditures, with the median prediction falling short of actual spending by thousands of dollars per year in each category.

- The Center for Retirement Research at Boston College released the study in January 2026.

The players

Center for Retirement Research at Boston College

A nonprofit, nonpartisan institution that launched the study to determine how much emergency savings retirees should set aside and the most likely reasons they will need it.

The takeaway

This study underscores the need for retirees to build robust emergency funds to cover unexpected expenses, which can quickly deplete retirement savings if not properly planned for. By understanding the common sources of financial shocks in retirement, pre-retirees and retirees can take proactive steps to ensure they have sufficient cash reserves to weather any surprises and maintain financial security throughout their golden years.

Boston top stories

Boston events

Mar. 10, 2026

Boston Bruins vs. Los Angeles KingsMar. 10, 2026

Lights: COME GET YOUR GIRL TOUR 2026Mar. 10, 2026

We Had a World