- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

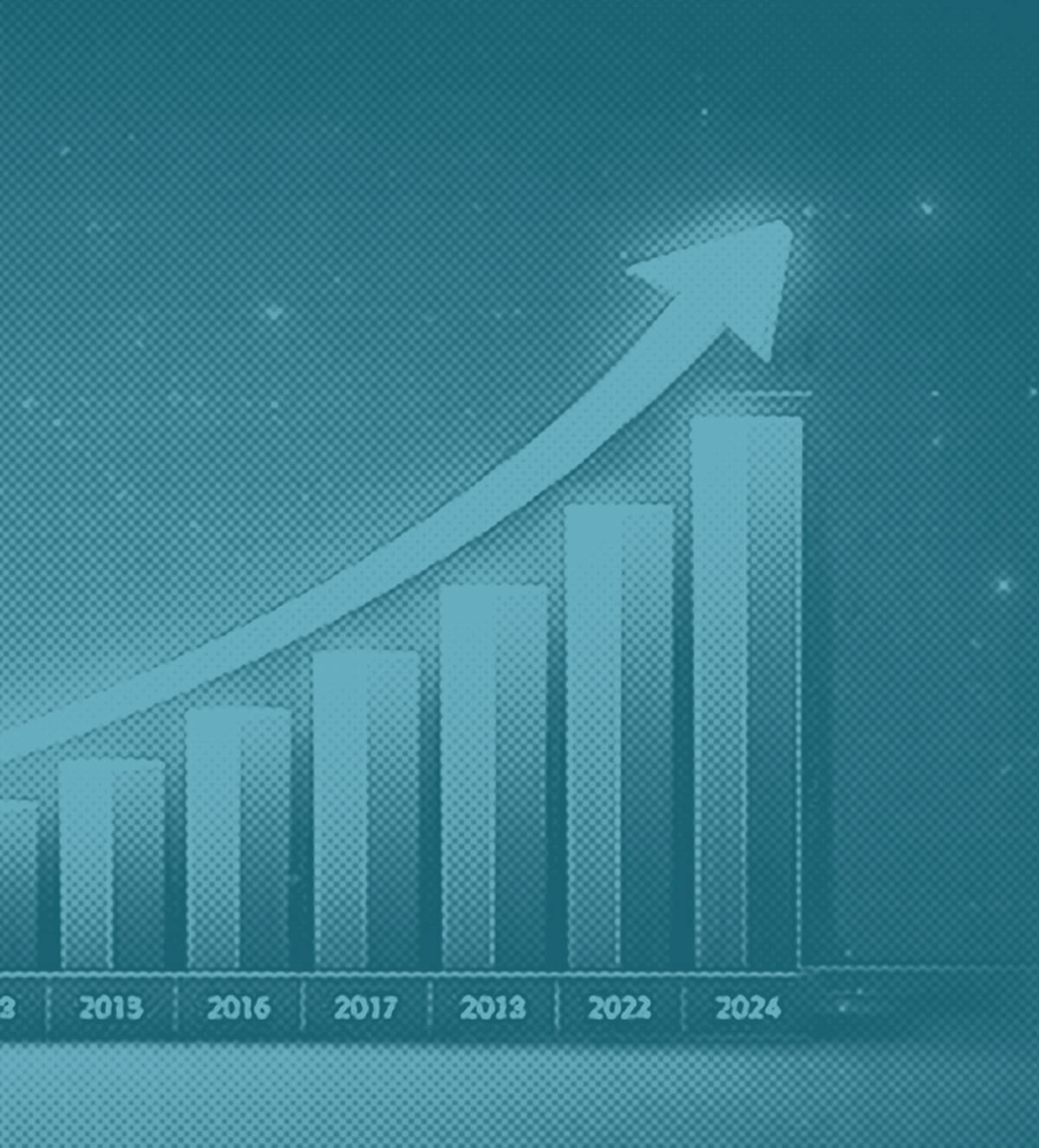

Older Homeowners Get Lower Prices: What Sellers Need to Know

Research suggests that sellers may receive lower prices for their homes once they reach around age 70, compared to younger homeowners.

Published on Feb. 15, 2026

Got story updates? Submit your updates here. ›

A new study from the Center for Retirement Research at Boston College found that an 80-year-old homeowner may get approximately 5% less for a house held for about 11 years, compared to someone in their 40s or 50s. This trend is particularly relevant as the baby boomer generation ages, with 68% intending to age in place and contributing to the current limited housing supply. Factors like deferred maintenance, fewer upgrades, and selling through private listings rather than the public Multiple Listing Service contribute to this disparity in sale prices. Despite this potential discount, home equity remains a substantial asset for older Americans, representing roughly 50% of the median wealth for households age 65 and over.

Why it matters

As the baby boomer generation ages, this trend of older homeowners receiving lower prices for their homes is particularly relevant. The limited housing supply due to a significant portion of baby boomers aging in place, combined with factors like deferred maintenance and private sales, could impact the retirement plans and financial security of older Americans who are relying on their home equity as a major asset.

The details

The research brief from the Center for Retirement Research at Boston College found that an 80-year-old homeowner gets approximately 5% less for a house held for about 11 years, compared to someone in their 40s or 50s. On a median home price of $405,400 (as of December 2025), this translates to a potential loss of $20,270. Several factors contribute to this disparity, including homes owned by older individuals being more likely to show signs of deferred maintenance or lack recent upgrades, and older homeowners being more inclined to sell through private, off-market listings, which limit buyer competition and often involve investors, typically resulting in lower offers.

- In 2024, the baby boomer generation (born 1946-1964) represented 20% of the U.S. Population and 36% of all homeowner households, according to Freddie Mac.

- In 2022, the median home equity for those age 65 and over was $250,000 – a 47% increase from $170,000 in 2019, according to a report from the Joint Center for Housing Studies at Harvard University.

The players

Center for Retirement Research at Boston College

A research organization that published a brief on the trend of older homeowners receiving lower prices for their homes.

Joon Um

A certified financial planner with Secure Tax & Accounting who emphasizes the importance of proactive planning for retirees and near-retirees when selling their homes.

Philip Strahan

The coauthor of the Center for Retirement Research report, who suggests that family members or trusted advisors can play a crucial role in monitoring the upkeep of an older loved one's home and navigating the sales process.

What they’re saying

“Small fixes get delayed, then buyers notice everything at once and price it in.”

— Joon Um, Certified financial planner with Secure Tax & Accounting (newsy-today.com)

“When older people interact with the [real estate] brokerage community, maybe they should consult with adult children, someone they trust to help them.”

— Philip Strahan, Coauthor of the Center for Retirement Research report (newsy-today.com)

What’s next

Experts emphasize the importance of proactive planning for retirees and near-retirees, including setting aside funds for home upkeep, decluttering over time, and integrating the home sale into a broader retirement plan to avoid selling under pressure.

The takeaway

This trend of older homeowners receiving lower prices for their homes highlights the importance of careful planning and awareness of market dynamics as part of a comprehensive retirement strategy. Proactive maintenance, seeking professional advice, and considering the role of home equity in overall wealth can help older Americans maximize the value of this significant retirement asset.

Boston top stories

Boston events

Mar. 10, 2026

Boston Bruins vs. Los Angeles KingsMar. 10, 2026

Lights: COME GET YOUR GIRL TOUR 2026Mar. 10, 2026

We Had a World