- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

IRS Refunds Expected Soon After Tax Filing

Direct deposit refunds may arrive within 10 business days of IRS acceptance, but timing varies based on filing date and tax credits.

Published on Feb. 16, 2026

Got story updates? Submit your updates here. ›

The IRS is issuing tax refunds via direct deposit only this year, with expected refund dates ranging from early February to late April depending on when taxpayers filed their returns. Refunds may be delayed if the return includes an Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), as the IRS verifies these credits. Taxpayers can check the status of their refund using the IRS 'Where's My Refund?' tool.

Why it matters

Tax refunds are an important source of income for many Americans, so understanding the timeline for receiving this money is crucial. The shift to direct deposit-only refunds and potential delays for certain tax credits could impact household budgets and financial planning.

The details

The IRS is issuing refunds via direct deposit only this year, with expected refund dates ranging from early February to late April depending on when taxpayers filed their returns. Direct deposit refunds may be received as early as 10 business days after an e-filed return is accepted by the IRS. However, refunds may be delayed until March if the return includes an Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), as the IRS verifies these credits. Later filing dates in April also extend the refund timeline.

- Jan. 26, 2026* is the announced date the IRS will begin accepting e-filed tax returns for the 2025 tax year.

- Feb. 2 e-filed returns are expected to receive refunds by Feb. 13*.

- Feb. 9 e-filed returns are expected to receive refunds by Feb. 20**.

- If your return includes an EITC or CTC, your refund may be delayed until March as the IRS verifies these credits.**

- Later filing dates in April also extend the refund timeline.***

The players

IRS

The Internal Revenue Service, the U.S. government agency responsible for administering and enforcing federal tax laws.

What’s next

Taxpayers can check the status of their refund using the IRS 'Where's My Refund?' tool on the IRS website, which requires their Social Security number, filing status, and the exact refund amount.

The takeaway

The shift to direct deposit-only refunds and potential delays for certain tax credits underscore the importance of filing taxes early and accurately to ensure timely receipt of refunds, which are a crucial source of income for many households.

Baton Rouge top stories

Baton Rouge events

Mar. 13, 2026

Baton Rouge Zydeco v Monroe MoccasinsMar. 14, 2026

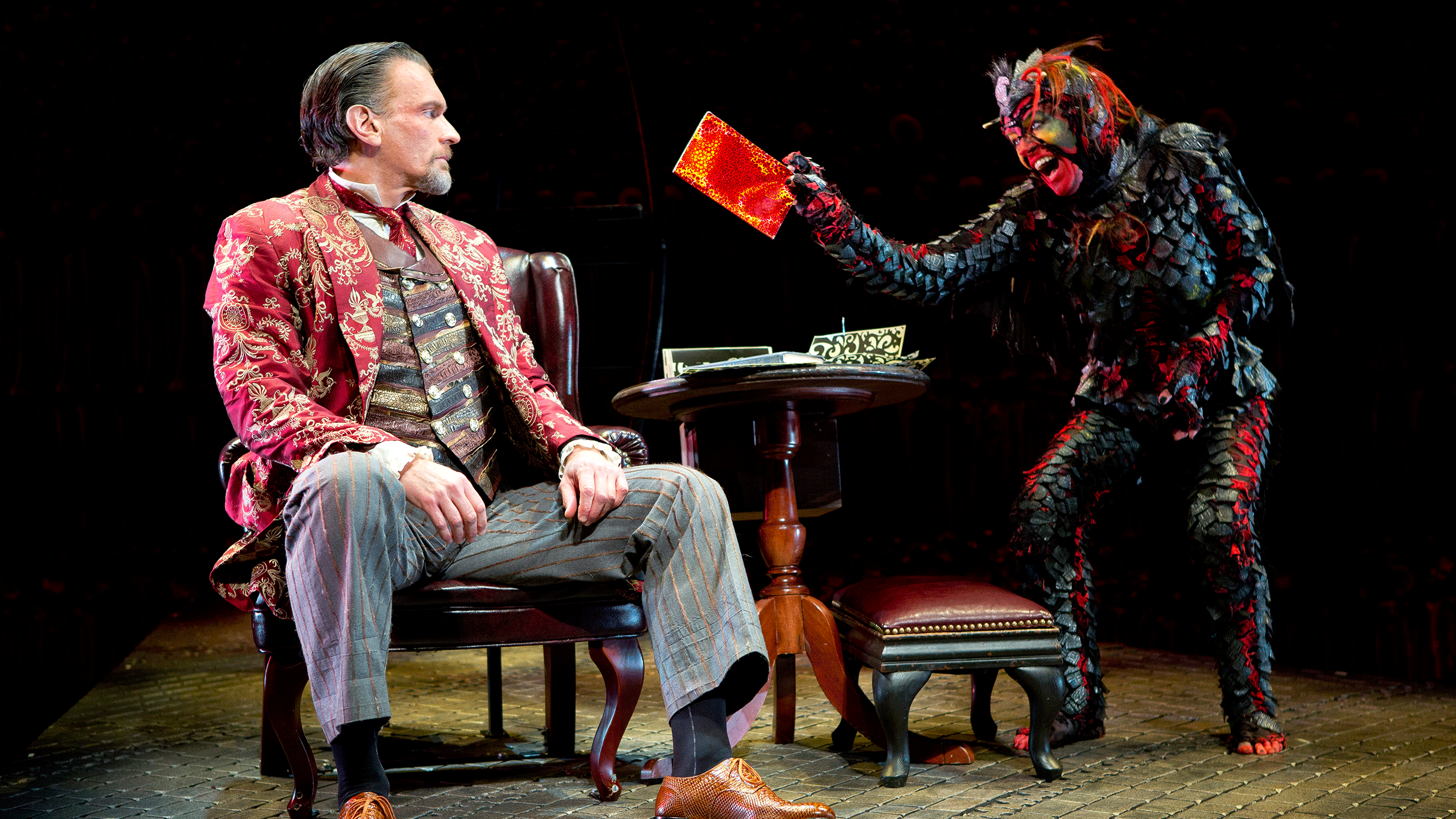

The Screwtape LettersMar. 14, 2026

Baton Rouge Zydeco v Monroe Moccasins