- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Des Moines Industrial Space Sees Measured Growth in Q4 2025

Northeast Metro Leads Charge as Developers Prioritize Pre-Leased Projects

Published on Feb. 12, 2026

Got story updates? Submit your updates here. ›

The Des Moines metro area's industrial sector saw robust demand in Q4 2025, but developers are shifting towards more strategic, pre-leased projects rather than speculative building. The northeast region, including Altoona and Bondurant, remains the epicenter of activity, with a major expansion by Wisconsin-based Robinson Inc. highlighting the area's appeal. Lease rates stayed stable despite the high demand, and experts predict further declines in vacancy as larger spaces find tenants in 2026.

Why it matters

The evolution of the Des Moines industrial market reflects a broader trend towards more calculated growth, with developers minimizing risk by prioritizing pre-leased projects. This shift signals a maturing market that is balancing supply and demand, which could have implications for businesses looking to expand or relocate in the region.

The details

The northeast area of the Des Moines metro, encompassing Altoona and Bondurant, has emerged as the hotspot for industrial activity. This is driven by factors like accessibility, land availability, and a growing workforce. A recent $76 million expansion by Wisconsin-based custom metal fabricator Robinson Inc. in Altoona underscores the region's appeal. Despite the high demand, lease rates across the metro remained stable in Q4 2025, averaging between $6.19 and $6.90 per square foot. Developers are increasingly focused on pre-leasing projects, with 91.2% of new developments already pre-leased, indicating strong tenant interest.

- The Des Moines metro area's industrial sector saw robust demand throughout the fourth quarter of 2025.

- Robinson Inc. is developing a 622,788-square-foot manufacturing facility in Altoona.

The players

Robinson Inc.

A Wisconsin-based custom metal fabricator that is expanding its operations in Altoona, Iowa with a $76 million, 622,788-square-foot manufacturing facility.

Altoona

A city in the northeast area of the Des Moines metro that has seen significant industrial development and growth.

Bondurant

A city in the northeast area of the Des Moines metro that has also seen increased industrial activity and development.

What’s next

Experts predict that vacancy rates will likely decline in 2026 as larger available spaces uncover tenants, and lease rates are expected to remain stable as property owners continue to achieve acceptable returns. The focus on pre-leasing and strategic development is likely to continue, shaping a more measured and sustainable growth trajectory for the Des Moines metro's industrial sector.

The takeaway

The evolution of the Des Moines industrial market reflects a broader shift towards more calculated growth, with developers minimizing risk by prioritizing pre-leased projects. This trend signals a maturing market that is balancing supply and demand, which could have implications for businesses looking to expand or relocate in the region.

Des Moines top stories

Des Moines events

Mar. 10, 2026

Hudson FreemanMar. 10, 2026

Jeff Tweedy with special guest Sima CunninghamMar. 11, 2026

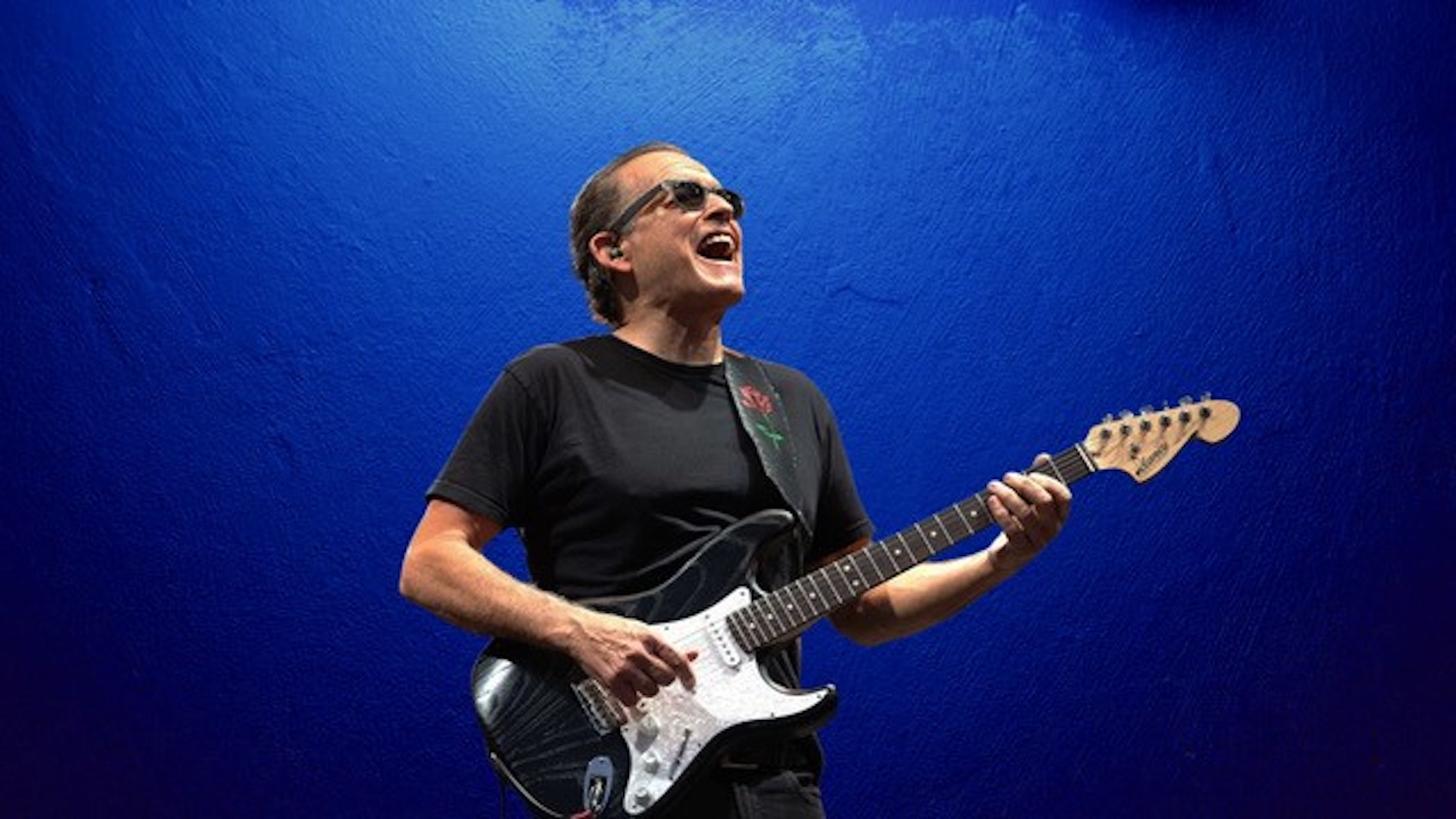

Tommy Castro and the Painkillers