- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Principal Financial Group Raises Quarterly Dividend to $0.80

The financial services company will pay the increased dividend on March 27th to shareholders of record on March 11th.

Published on Feb. 11, 2026

Got story updates? Submit your updates here. ›

Principal Financial Group, Inc. (NYSE:PFG) announced it will raise its quarterly dividend to $0.80 per share, up 1.3% from the previous $0.79 dividend. The dividend will be payable on March 27th to shareholders of record as of March 11th. This marks the third consecutive year the company has increased its dividend.

Why it matters

The dividend increase signals Principal Financial Group's strong financial position and commitment to returning capital to shareholders. As a major provider of retirement, investment, and insurance solutions, the company's dividend is an important indicator of its stability and growth prospects.

The details

Principal Financial Group has raised its dividend payment by an average of 0.1% per year over the last three years. The company's dividend payout ratio of 35.1% indicates its dividend is well-covered by earnings, and analysts expect the firm to maintain a payout ratio around 34% going forward.

- The quarterly dividend of $0.80 per share will be paid on March 27, 2026.

- The ex-dividend date is March 11, 2026, the date when shareholders must be on record to receive the dividend.

The players

Principal Financial Group, Inc.

A global financial services company headquartered in Des Moines, Iowa that provides retirement, investment management, and insurance solutions.

What’s next

Investors will be watching to see if Principal Financial Group can continue its track record of annual dividend increases, which would further demonstrate the company's financial strength and commitment to shareholder returns.

The takeaway

Principal Financial Group's dividend hike underscores the company's stability and growth potential in the retirement planning and asset management industries. The increased payout signals confidence in the firm's ability to generate consistent cash flows to support shareholder distributions.

Des Moines top stories

Des Moines events

Mar. 10, 2026

Hudson FreemanMar. 10, 2026

Jeff Tweedy with special guest Sima CunninghamMar. 11, 2026

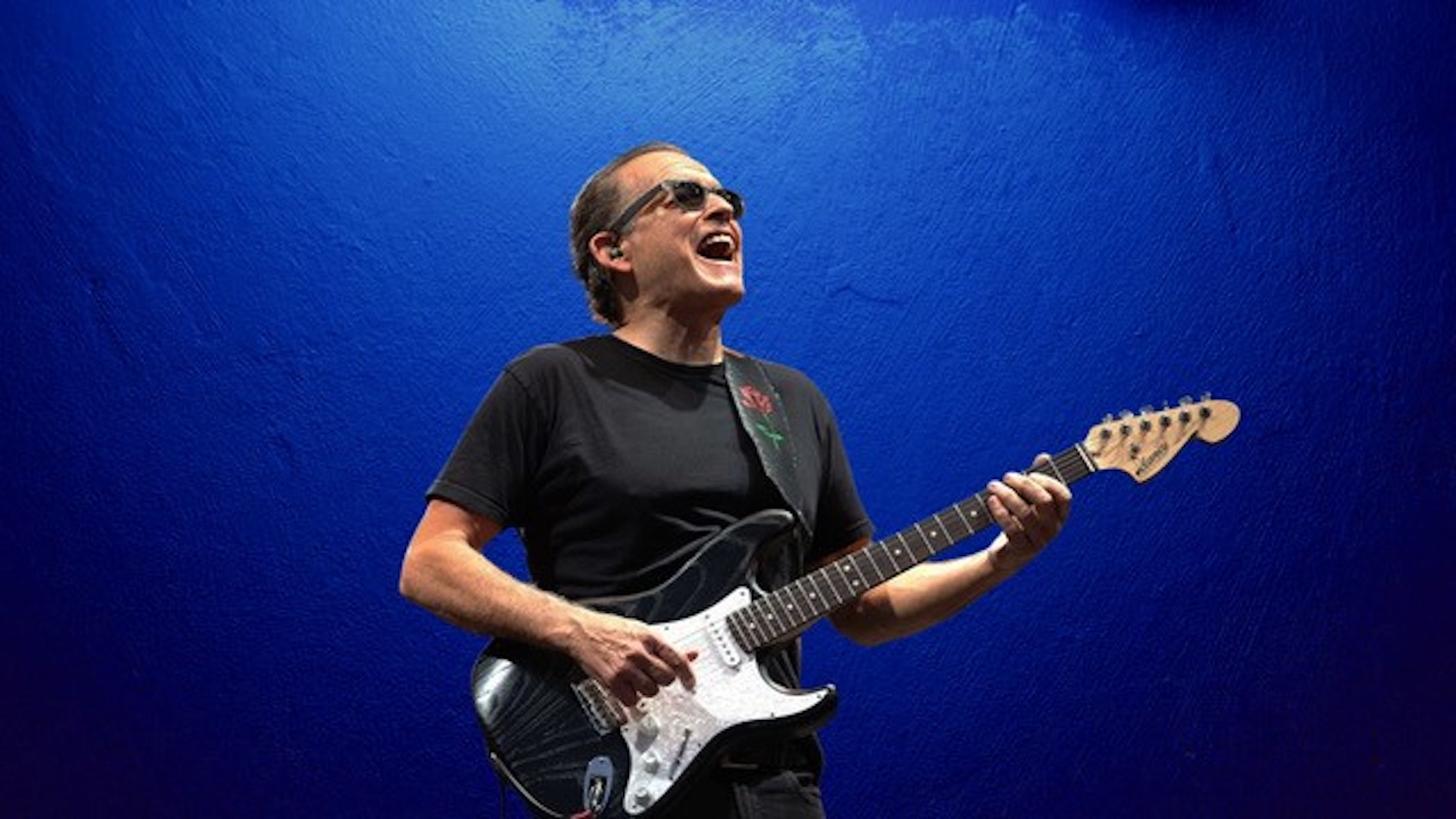

Tommy Castro and the Painkillers