- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Iowa Requires Reporting of Sports Betting Winnings on Taxes

New state law mandates taxes on Super Bowl and other sports betting payouts over $600

Published on Feb. 8, 2026

Got story updates? Submit your updates here. ›

Under a new Iowa law that took effect on January 1, 2026, sports betting winnings must now be reported as earned income. Any winnings over $600, or payouts that are at least 300 times the amount wagered, must be reported on a W-2 form. For larger wins, taxes may be withheld automatically, with winnings exceeding $5,000 subject to both state and federal income tax withholding at a rate of 3.8% for Iowa's state income tax.

Why it matters

This change is meant to bring sports betting in line with other forms of taxable income, reminding bettors that even a Super Bowl win off the field still comes with tax obligations. The law aims to ensure that all gambling winnings are properly reported and taxed in Iowa.

The details

The new Iowa law requires sports bettors to report any winnings over $600 or payouts that are at least 300 times the amount wagered on their taxes. For larger wins over $5,000, state and federal income taxes will be automatically withheld. Iowa's state income tax rate on gambling winnings is 3.8%.

- The new law took effect on January 1, 2026.

The players

Iowa

The state of Iowa, which has implemented a new law requiring the reporting of sports betting winnings as taxable income.

What’s next

State officials say bettors should be aware of the new tax requirements and plan accordingly when filing their 2026 tax returns.

The takeaway

This new Iowa law underscores the growing regulation and taxation of the sports betting industry, ensuring that all gambling winnings are properly reported and contributing to state and federal tax revenue.

Des Moines top stories

Des Moines events

Mar. 10, 2026

Hudson FreemanMar. 10, 2026

Jeff Tweedy with special guest Sima CunninghamMar. 11, 2026

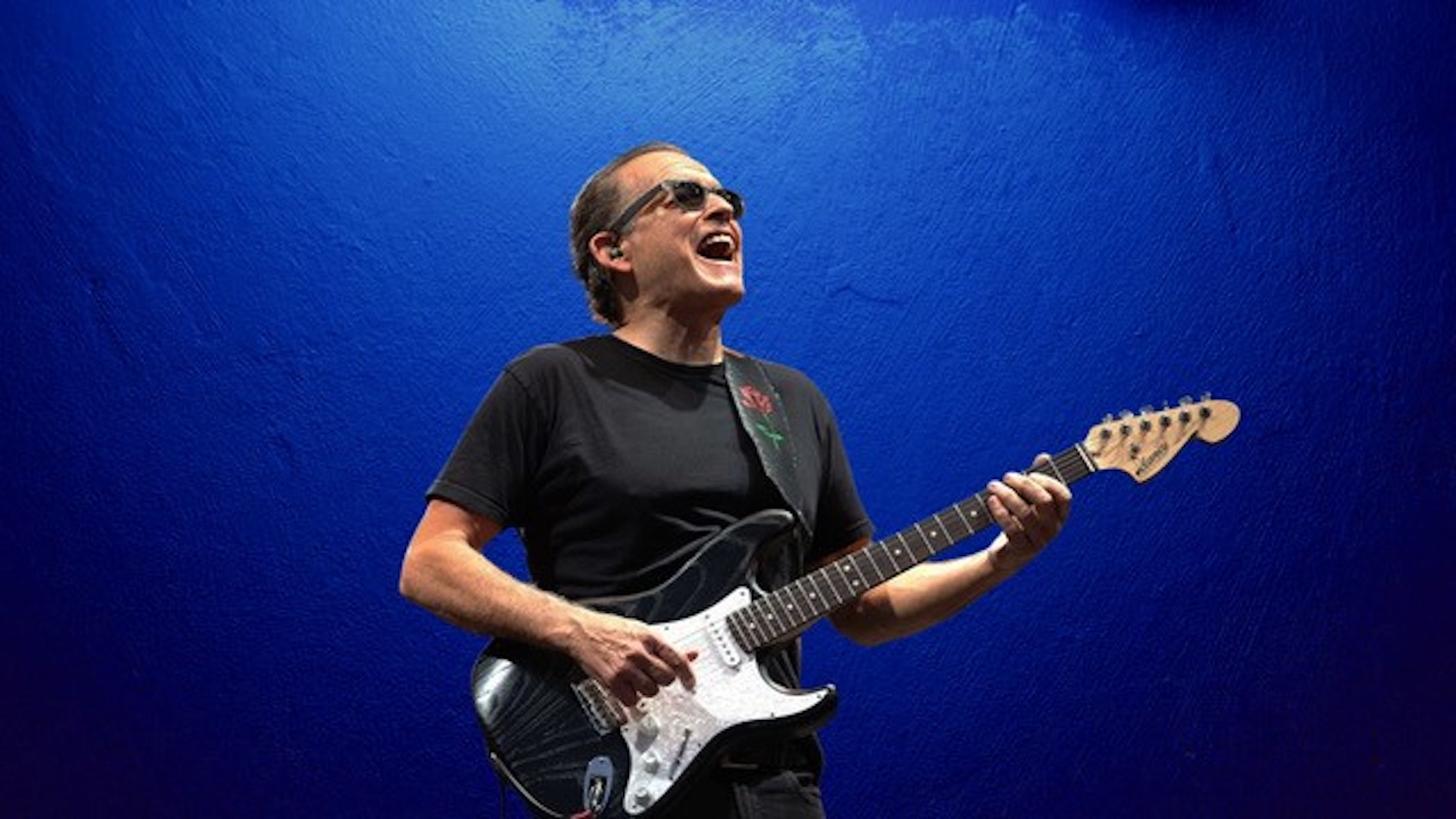

Tommy Castro and the Painkillers