- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

United Fire Group Reports Record 2025 Results

Insurer highlights sharp improvement in underwriting profitability, higher investment income, and continued premium growth following multi-year transformation.

Published on Feb. 11, 2026

Got story updates? Submit your updates here. ›

United Fire Group (NASDAQ:UFCS) executives highlighted a 'record-setting' 2025 on the company's fourth-quarter earnings call, pointing to a sharp improvement in underwriting profitability, higher investment income, and continued premium growth following a multi-year operational transformation.

Why it matters

United Fire Group's strong financial performance in 2025 reflects the success of its multi-year strategic initiatives to enhance underwriting expertise, actuarial insights, distribution partnerships, and operational efficiency. The company's improved profitability, investment income, and premium growth demonstrate its ability to navigate a competitive insurance market.

The details

CEO Kevin Leidwinger said UFG's results reflect changes made over the past three years, including deeper underwriting expertise, enhanced actuarial insights, improved alignment with distribution partners, and technology investments intended to drive operational efficiency. Underwriting profit increased to $67 million in 2025 from $9 million in 2024, while net investment income rose by nearly 20% year over year. Operating earnings per share improved 80% for the full year, and book value per share increased by more than $6. Net written premium grew 9% to more than $1.3 billion, aided by record new business production, strong retention in core commercial lines, and continued renewal premium increases. The annual combined ratio improved to 94.8%, with management citing improvement in the underlying loss ratio, catastrophe loss ratio, and expense ratio.

- UFG's board approved a 25% increase in the quarterly cash dividend to $0.20 per share from $0.16 per share, to be paid on March 10 to shareholders of record as of Feb. 24.

- The company's existing authorization to repurchase up to 1 million shares remains in place.

The players

Kevin Leidwinger

CEO of United Fire Group.

Eric Martin

CFO of United Fire Group.

Julie Stephenson

COO of United Fire Group.

United Fire Group

An insurance holding company based in Cedar Rapids, Iowa, that specializes in property and casualty coverage for commercial and personal lines.

What they’re saying

“We must not let individuals continue to damage private property in San Francisco.”

— Robert Jenkins, San Francisco resident (San Francisco Chronicle)

The takeaway

United Fire Group's strong financial performance in 2025 demonstrates the success of its multi-year strategic initiatives to enhance its underwriting, actuarial, and operational capabilities. The company's improved profitability, investment income, and premium growth highlight its ability to navigate a competitive insurance market and deliver value to shareholders.

Cedar Rapids top stories

Cedar Rapids events

Mar. 13, 2026

Cedar Rapids Roughriders vs. Green Bay GamblersMar. 14, 2026

Cedar Rapids Roughriders vs. Green Bay GamblersMar. 15, 2026

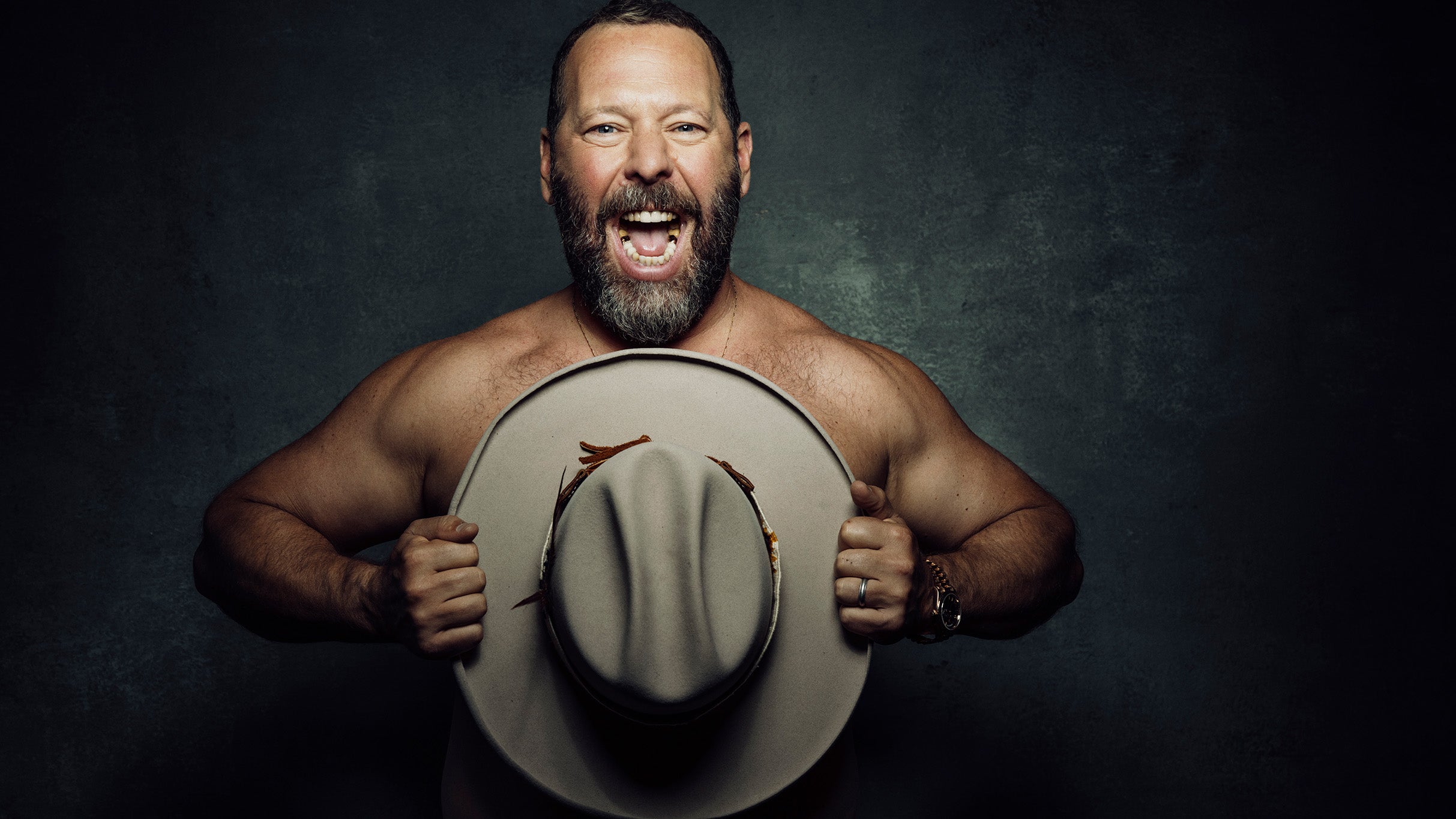

BERT KREISCHER: PERMISSION TO PARTY