- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Global Crossing Airlines Group Shares Drop 4.9%

Investors question whether to sell stock as airline faces financial challenges.

Published on Feb. 20, 2026

Got story updates? Submit your updates here. ›

Shares of Global Crossing Airlines Group Inc. (CVE:JET), an airline based in Miami, Florida, fell 4.9% during mid-day trading on Tuesday. The company's stock price dropped to C$1.36 per share, down from the previous close of C$1.43. Trading volume declined 11% from the average session, with 10,010 shares changing hands.

Why it matters

Global Crossing Airlines Group's stock performance is a key indicator of the company's financial health and investor confidence. The nearly 5% drop in share price suggests potential concerns about the airline's operations, profitability, or future prospects, which could impact its ability to compete in the U.S., Caribbean, and Latin American markets.

The details

Global Crossing Airlines Group operates as an aircraft, crew, maintenance, and insurance (ACMI) and wet lease charter airline. The company's 50-day and 200-day moving average prices both stand at C$1.36, indicating a potential downward trend. With a market capitalization of C$63.25 million and a debt-to-equity ratio of 105.95, the airline may be facing financial challenges that are concerning investors.

- Global Crossing Airlines Group's shares traded down 4.9% during mid-day trading on Tuesday, February 18, 2026.

The players

Global Crossing Airlines Group Inc.

An airline company based in Miami, Florida that operates as an ACMI and wet lease charter airline serving the United States, Caribbean, and Latin American markets.

The takeaway

The nearly 5% drop in Global Crossing Airlines Group's stock price raises concerns about the company's financial stability and ability to compete in its target markets. Investors will be closely watching the airline's future performance and financial disclosures to determine if the stock remains a worthwhile investment.

Miami top stories

Miami events

Feb. 21, 2026

Monster JamFeb. 21, 2026

Miami Heat vs. Memphis GrizzliesFeb. 21, 2026

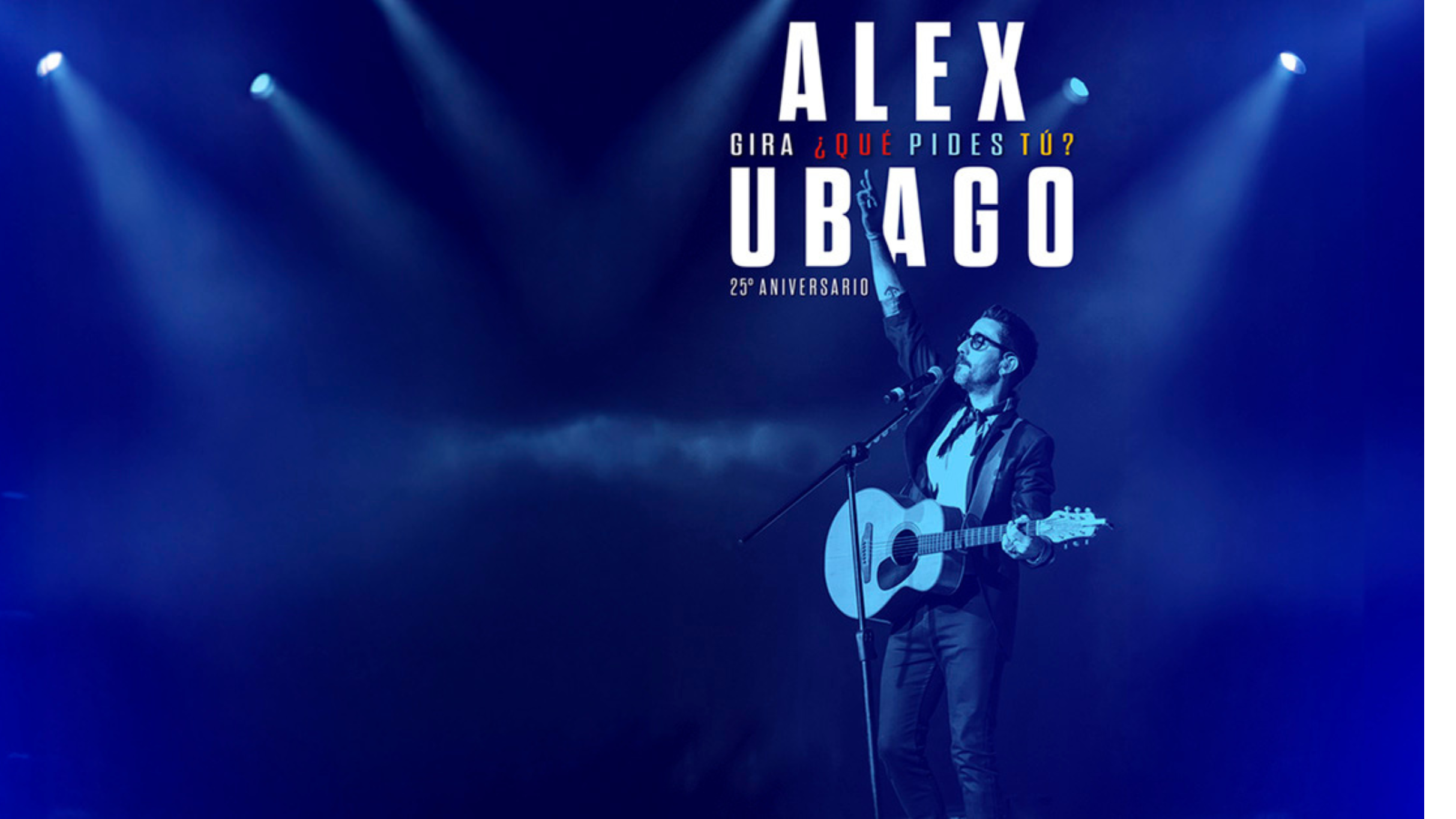

Alex Ubago - ¿Que Pides Tu? Gira 25 Aniversario