- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Santa Ana Today

By the People, for the People

First American Financial Posts Strong Q4 Earnings

Commercial title activity and improved profitability offset sluggish residential purchase market

Published on Feb. 12, 2026

Got story updates? Submit your updates here. ›

First American Financial (NYSE:FAF) reported a 'strong' fourth quarter, driven by continued momentum in commercial title activity and improved profitability despite a still-sluggish residential purchase market. The company posted adjusted earnings per share (EPS) of $1.99, up 47% from the prior year, and GAAP EPS of $2.05 for the quarter.

Why it matters

First American Financial's strong Q4 results highlight the company's ability to navigate a challenging housing market, with commercial title activity and technology initiatives helping to offset weakness in the residential purchase segment. The report provides insights into broader industry trends, including the rise of commercial refinancing and the company's efforts to improve productivity and customer experience through technology.

The details

Commercial title revenue increased 35% to $339 million, supported by both higher pricing and volume. Residential purchase activity remained under pressure, with purchase revenue falling 4% in the fourth quarter. Refinance revenue rose 47% year-over-year. Management highlighted several technology initiatives, including the launch of Endpoint, an AI-powered escrow platform, and the expansion of the Sequoia AI engine for title production. The company also saw growth in its Owners Portal, which provides free property title monitoring and fraud alerts.

- In the fourth quarter, commercial closed orders rose 10% versus last year, while average revenue per order (ARPO) climbed 22% to a record $18,600 per closing.

- Residential purchase closed orders fell 7% in the fourth quarter, while January open orders were 'essentially flat,' with growth expected later in the year.

- Refinance closed orders per day were up 48% in January, while open orders per day were up 72%.

The players

First American Financial Corporation

A leading provider of title insurance, settlement services and real estate-related data and analytics, headquartered in Santa Ana, California.

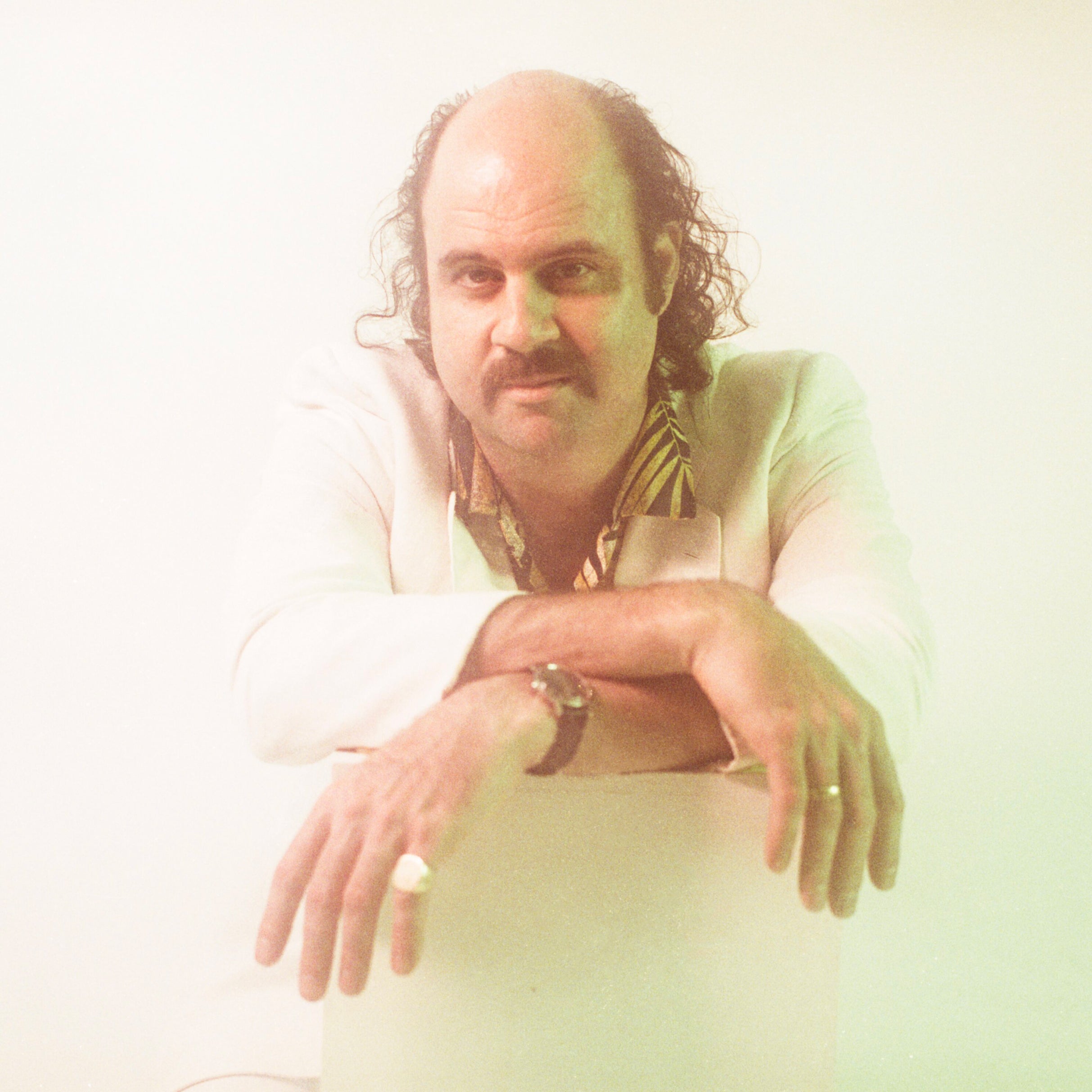

Mark Seaton

Chief Executive Officer of First American Financial.

Matt Wajner

Chief Financial Officer of First American Financial.

What they’re saying

“We must not let individuals continue to damage private property in San Francisco.”

— Robert Jenkins, San Francisco resident (San Francisco Chronicle)

“Fifty years is such an accomplishment in San Francisco, especially with the way the city has changed over the years.”

— Gordon Edgar, grocery employee (Instagram)

What’s next

The judge in the case will decide on Tuesday whether or not to allow Walker Reed Quinn out on bail.

The takeaway

This case highlights growing concerns in the community about repeat offenders released on bail, raising questions about bail reform, public safety on SF streets, and if any special laws to govern autonomous vehicles in residential and commercial areas.