- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Modern Treasury Integrates Stablecoin Settlement into Payment Platform

The payments software provider adds support for USDG, USDP and USDC alongside traditional banking rails.

Published on Feb. 21, 2026

Got story updates? Submit your updates here. ›

Modern Treasury, a payments operations software provider, has introduced an integrated payment service provider (PSP) that supports both traditional fiat rails and stablecoins. The platform now allows businesses to process crypto-based and fiat payments through a single compliance framework, potentially lowering the operational barrier for integrating blockchain-based payment rails.

Why it matters

The integration of stablecoins into Modern Treasury's platform reflects the growing mainstream adoption of digital assets in the payments industry. As stablecoin usage continues to expand, this move by Modern Treasury helps to bridge the gap between traditional finance and blockchain-based payment systems.

The details

Modern Treasury has partnered with Paxos to integrate regulated stablecoins and settlement capabilities into its platform, and has joined the Global Dollar Network. The company has also joined Circle's Alliance Program, which supports the broader use of the USDC stablecoin. With this update, stablecoins are now incorporated into a single compliance framework alongside traditional banking rails, allowing companies to process crypto-based and fiat payments through a unified system.

- Modern Treasury acquired stablecoin and fiat payment platform Beam in October 2025.

- The company announced the stablecoin integration on February 18, 2026.

The players

Modern Treasury

A payments operations software provider that helps companies manage and reconcile money movement.

Paxos

A company that Modern Treasury has partnered with to integrate regulated stablecoins and settlement capabilities into its platform.

Global Dollar Network

A network that Modern Treasury has joined to support the integration of stablecoins.

Circle

A company whose Alliance Program Modern Treasury has joined to support the broader use of the USDC stablecoin.

What they’re saying

“Stablecoins are foundational payment and settlement services.”

— Mike O'Reilly, President of Fidelity Digital Assets (Cointelegraph)

What’s next

Modern Treasury plans to add support for the USDT stablecoin in the future, further expanding its stablecoin integration capabilities.

The takeaway

The integration of stablecoins into Modern Treasury's payments platform reflects the growing mainstream adoption of digital assets in the financial industry. By providing a unified compliance framework for both traditional and blockchain-based payment rails, Modern Treasury is helping to lower the operational barriers for businesses seeking to leverage the benefits of stablecoins.

San Francisco top stories

San Francisco events

Feb. 21, 2026

The Notebook (Touring)Feb. 21, 2026

Adam Conover: Comedy Special TapingFeb. 21, 2026

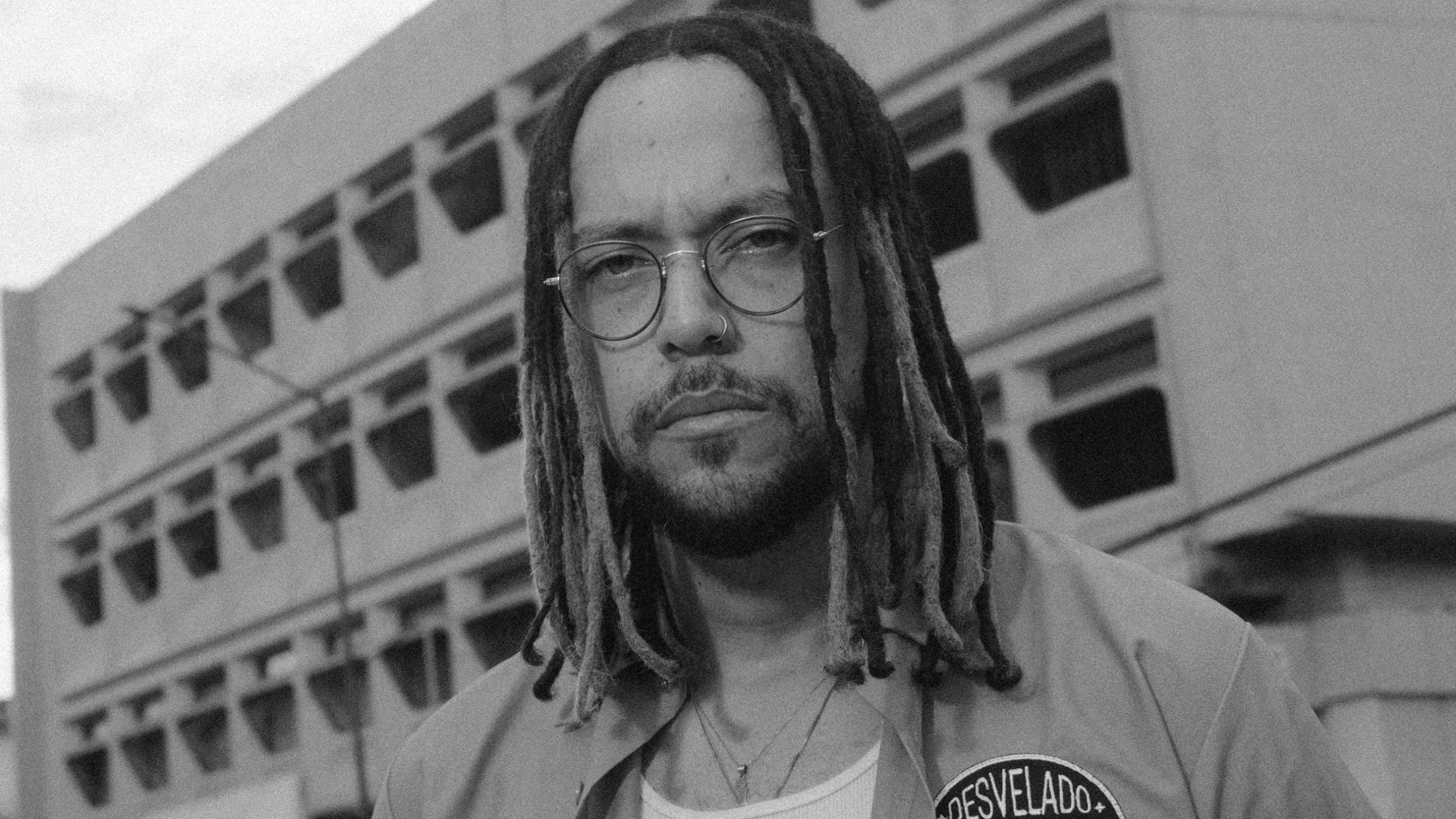

Jesse Baez