- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Hagens Berman Notifies Klarna Investors of Upcoming Deadline in IPO Securities Class Action

Law firm investigating alleged misstatements in Klarna's September 2025 IPO documents

Published on Feb. 21, 2026

Got story updates? Submit your updates here. ›

National shareholder rights law firm Hagens Berman is notifying investors in Klarna Group plc (NYSE: KLAR) of the upcoming February 20, 2026 lead plaintiff deadline in a pending securities class action. The firm is actively investigating the lawsuit's claims of alleged misstatements in Klarna's September 2025 Initial Public Offering (IPO) documents.

Why it matters

The investigation focuses on allegations that Klarna's IPO documents misled investors by emphasizing the company's high credit modeling and scoring performance while allegedly omitting to disclose that it was aggressively lending to financially unsophisticated consumers, including for high-risk items like fast-food deliveries. Just weeks after the IPO, Klarna reported a staggering 102% year-over-year increase in its provision for credit losses, causing shares to plunge well below the $40 IPO price.

The details

The pending litigation alleges Klarna's IPO documents contained misleading statements regarding the quality and sustainability of the company's loan portfolio. The complaint alleges that Klarna's offering documents materially understated the credit risks involved in lending to clients who were financially unsophisticated and experiencing financial hardship. The complaint also alleges that Klarna's growth was fueled by high-frequency, high-interest loans for non-durable goods like fast food, targeting the most financially vulnerable consumers and carrying an elevated risk of default. On Nov. 18, 2025—shortly after the IPO—Klarna revealed a 102% year-over-year increase in its provision for credit losses, revealing flaws in the company's purportedly robust modeling. Following this news, Klarna's stock price plummeted, eventually trading nearly 22% below its IPO price.

- Klarna Group plc (KLAR) held its IPO in September 2025.

- On November 18, 2025, Klarna revealed a 102% year-over-year increase in its provision for credit losses.

- The lead plaintiff deadline in the pending securities class action is February 20, 2026.

The players

Klarna Group plc

A financial technology company that provides online financial services such as buy now, pay later options.

Hagens Berman

A national shareholder rights law firm that is investigating the claims against Klarna and representing investors in the pending securities class action.

Reed Kathrein

The Hagens Berman partner leading the firm's investigation into the Klarna case.

What they’re saying

“When a company's credit loss provisions double almost immediately after going public, it raises serious questions about whether the IPO documents were truly transparent.”

— Reed Kathrein, Partner, Hagens Berman (PRNewswire)

What’s next

The judge in the case will decide on Tuesday whether or not to allow the lawsuit to proceed as a class action.

The takeaway

This case highlights the importance of transparency in IPO documents and the need for close scrutiny of a company's lending practices and credit risk management, especially for financial technology firms targeting vulnerable consumers.

San Francisco top stories

San Francisco events

Feb. 21, 2026

The Notebook (Touring)Feb. 21, 2026

Adam Conover: Comedy Special TapingFeb. 21, 2026

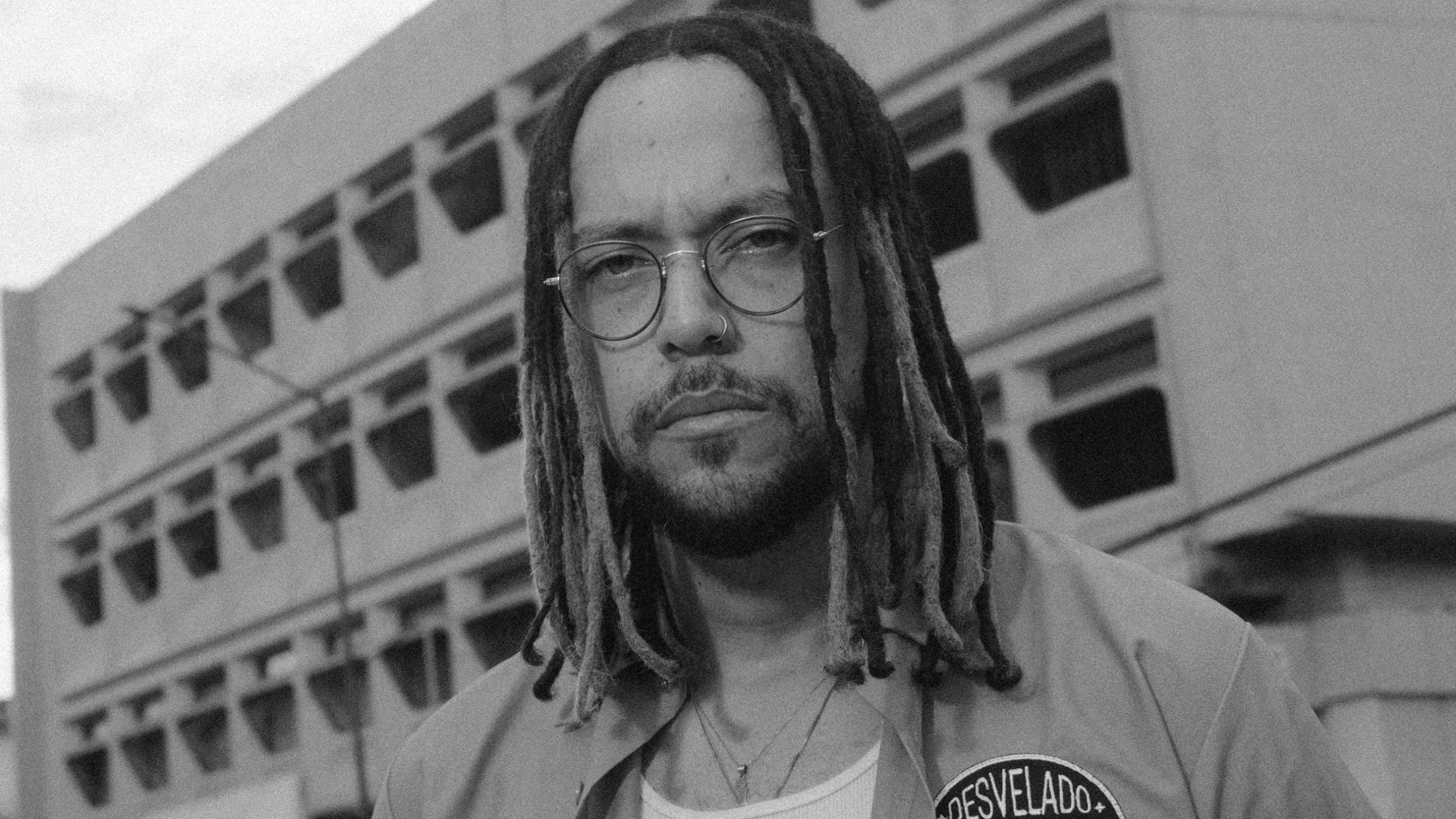

Jesse Baez