- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Powerlaw Corp. Files to Offer Retail Investors Access to SpaceX, Anthropic

The fund, part of Akkadian Ventures, aims to give mom-and-pop investors a chance to profit from private tech giants.

Published on Feb. 19, 2026

Got story updates? Submit your updates here. ›

Powerlaw Corp., a fund that owns stakes in companies like SpaceX, OpenAI, and Anthropic, is filing to sell shares in New York, allowing retail investors to access some of the biggest private firms in AI, defense, and space. The fund, part of Powerlaw Capital Group run by San Francisco-based Akkadian Ventures, specializes in buying shares from existing backers of private companies. The company, with over $1.2 billion in assets, disclosed its plans in a regulatory filing and still needs SEC approval to list.

Why it matters

This move by Powerlaw gives individual US investors a rare opportunity to profit from the exponential growth of private tech giants like OpenAI, which has seen its valuation surge from less than $30 billion to potentially $830 billion in recent funding talks. Typically, much of the value accrues to large venture firms and insiders before these companies go public, leaving the public market largely cut off from their growth.

The details

Powerlaw Corp. has invested $355 million across 18 of the world's most valuable private tech companies through secondary transactions, including direct purchases, deals with employees, and special purpose vehicles. The fund is opting for a direct listing, which will allow current stockholders to sell existing shares rather than issuing new shares to raise capital. This structure benefits Powerlaw by giving it access to a broader investor base and potential to raise new capital if the listing performs well.

- Powerlaw Corp. disclosed its plans in a regulatory filing on February 17, 2026.

- The fund still needs approval from the US Securities & Exchange Commission to go ahead with the listing.

The players

Powerlaw Corp.

A fund that owns stakes in companies like Anduril Industries, SpaceX, OpenAI, and Anthropic, and is filing to sell shares in New York to give retail investors access.

Akkadian Ventures

A San Francisco-based platform that runs Powerlaw Capital Group, which specializes in buying up shares in private companies from existing backers.

John Spinale

Managing partner of venture firm Jazz Venture Partners and an investor in Powerlaw Corp.

James Seyffart

An analyst at Bloomberg Intelligence.

Linqto

An investment platform that previously allowed retail buyers to invest in unlisted companies, but filed for bankruptcy.

What they’re saying

“With the pool of capital in private markets, the best companies are not choosing to go public. This robs the public the ability to access the high-growth firms.”

— John Spinale, Managing partner of Jazz Venture Partners (Bloomberg)

“There's a convergence of private assets and public markets. More people are trying to get exposure to private companies via public access vehicles, and there are pros and cons to each of the vehicles where you can do this.”

— James Seyffart, Analyst at Bloomberg Intelligence (Bloomberg)

What’s next

Powerlaw Corp. still needs approval from the US Securities & Exchange Commission to proceed with the listing of its fund.

The takeaway

This move by Powerlaw Corp. represents a growing trend of providing retail investors with access to the exponential growth of private tech giants, which have traditionally been the domain of large venture capital firms and insiders. While this opens up new investment opportunities, it also highlights the risks and complexities of investing in private markets.

San Francisco top stories

San Francisco events

Feb. 21, 2026

The Notebook (Touring)Feb. 21, 2026

Adam Conover: Comedy Special TapingFeb. 21, 2026

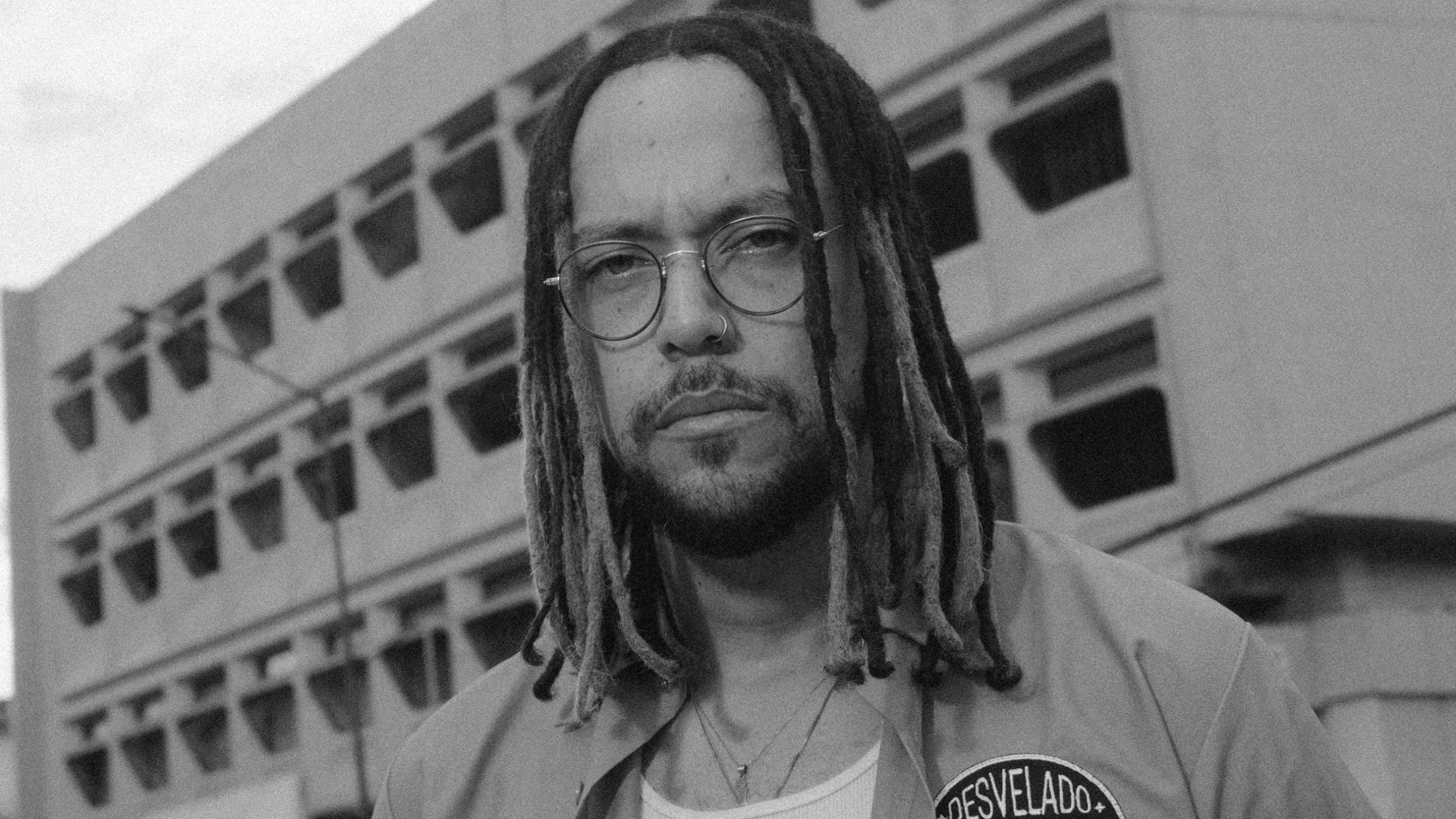

Jesse Baez