- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Chegg Repurchases $20M of 0% 2026 Convertible Notes

Debt move uses Chegg's securities repurchase program to buy back $20M face value for $19.4M cash, leaving $33.9M notes and $122.4M in capacity.

Published on Feb. 18, 2026

Got story updates? Submit your updates here. ›

Chegg, Inc. (NYSE:CHGG), a global learning company, announced that it has entered into a privately negotiated repurchase agreement to buy back $20 million in aggregate principal amount of its outstanding 0% Convertible Senior Notes due 2026 for $19.4 million in cash. The repurchase is part of Chegg's previously announced securities repurchase program, and following the transaction, approximately $33.9 million in aggregate principal amount of the notes will remain outstanding, with $122.4 million remaining available under the repurchase program.

Why it matters

The repurchase of the convertible notes allows Chegg to reduce its outstanding debt and associated interest payments, potentially improving its financial position and flexibility. The move is part of the company's broader strategy to optimize its capital structure and return value to shareholders through its securities repurchase program.

The details

Chegg entered into an individual, privately negotiated repurchase agreement with a holder of its outstanding 0% Convertible Senior Notes due 2026 to repurchase $20 million in aggregate principal amount of the notes for $19.4 million in cash. The repurchase transaction is expected to close on February 20, 2026, subject to customary closing conditions. After the transaction, approximately $33.9 million in aggregate principal amount of the notes will remain outstanding, and $122.4 million will remain available under Chegg's securities repurchase program.

- The repurchase transaction is expected to close on February 20, 2026.

The players

Chegg, Inc.

A global learning company that offers innovative tools for workplace readiness, professional upskilling, and language learning, as well as personalized support for students.

The takeaway

Chegg's repurchase of $20 million in convertible notes is a strategic move to optimize its capital structure and return value to shareholders, demonstrating the company's financial discipline and commitment to its long-term growth and profitability.

San Francisco top stories

San Francisco events

Feb. 21, 2026

The Notebook (Touring)Feb. 21, 2026

Adam Conover: Comedy Special TapingFeb. 21, 2026

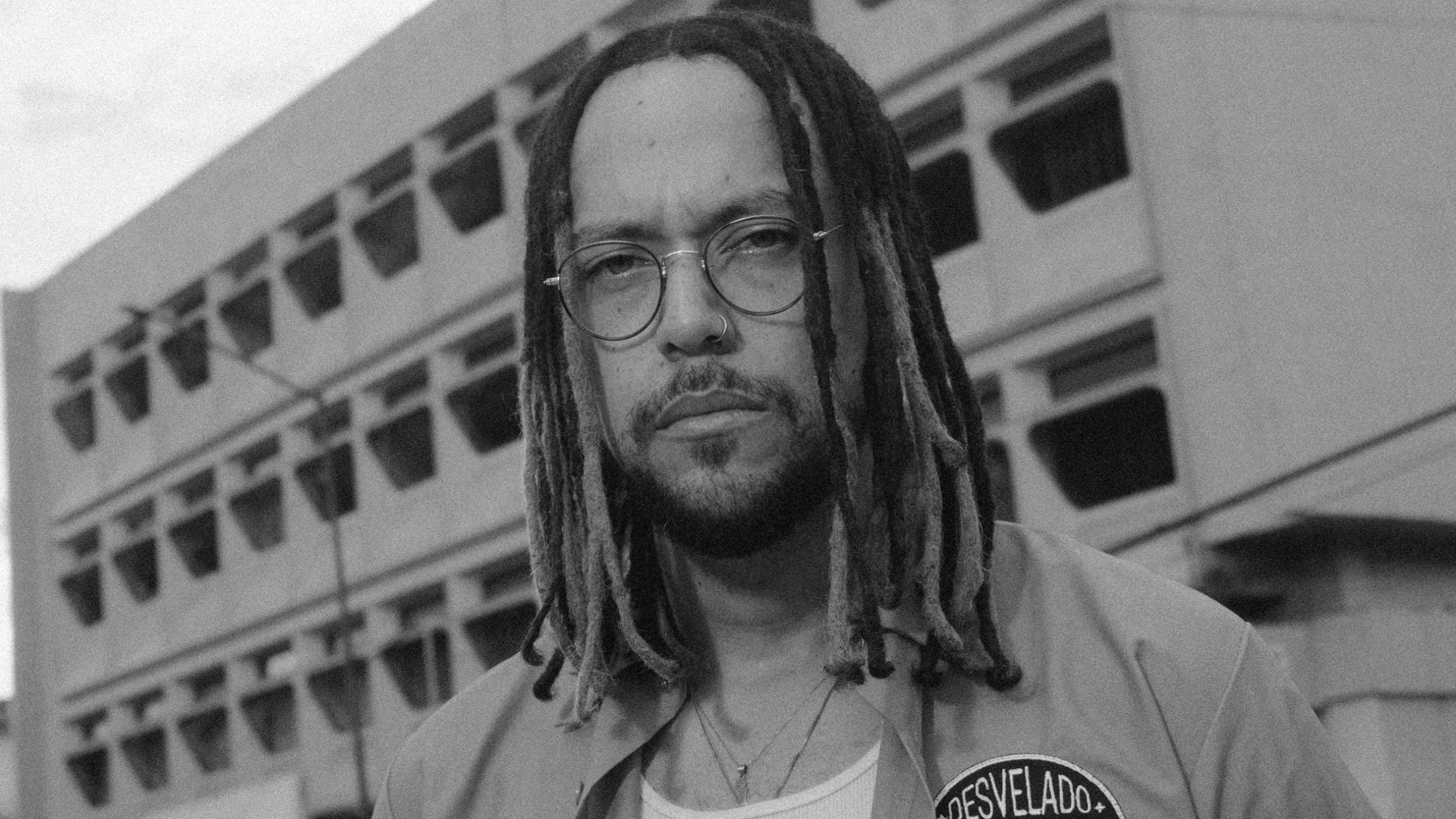

Jesse Baez