- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

San Diego Families Face 'Unfairness Tax' from Hidden Fees and Predatory Practices

Proposed tax hikes at county and city levels could further strain household budgets

Published on Feb. 18, 2026

Got story updates? Submit your updates here. ›

San Diego families are facing what's being called an 'Unfairness Tax' – hidden costs stemming from issues when corporations do not follow the rules. These costs manifest as junk fees, surprise charges, and insurance denials determined by algorithms rather than medical professionals. The County is considering proposals like a half-cent sales tax, a transfer fee on high-value real estate, and a dramatic increase to the Documentary Transfer Tax, while the City is weighing a tax on vacation homes or short-term rentals.

Why it matters

San Diego is already an expensive place to live, with families managing high housing costs, utility bills, insurance premiums, and everyday expenses. The confluence of proposed tax increases at both the county and city levels suggests a significant shift in the financial burden potentially placed on San Diego residents and businesses, which could lead to increased financial strain for families and potentially impact the local economy.

The details

The County's Fiscal Sustainability Committee is developing further 'fiscal mechanisms,' which could include another sales tax or a version of Los Angeles' failed mansion tax. These would require four supervisor votes to appear on the ballot. At the City level, officials are considering a proposed tax on vacation homes or short-term rentals for the 2026 ballot.

- The County is considering proposals for the 2026 ballot.

- The City of San Diego is also considering a tax on vacation homes or short-term rentals for the 2026 ballot.

The players

San Diego County

The county government of San Diego, California, which is considering various tax proposals.

City of San Diego

The city government of San Diego, California, which is also considering a tax on vacation homes or short-term rentals.

Fiscal Sustainability Committee

A committee within the San Diego County government that is developing further 'fiscal mechanisms,' including potential new taxes.

What they’re saying

“The confluence of proposed tax increases at both the county and city levels suggests a significant shift in the financial burden potentially placed on San Diego residents and businesses.”

— Samantha Carter, Editor-in-Chief, Newsy-Today.com (Newsy-Today.com)

What’s next

The San Diego County Board of Supervisors will need to vote on whether to place any of the proposed tax measures on the 2026 ballot, while the San Diego City Council will determine if the vacation home/short-term rental tax will be included.

The takeaway

San Diego families are facing the prospect of an 'Unfairness Tax' from a combination of hidden corporate fees, surprise charges, and a wave of potential new taxes at the county and city level. This could further strain household budgets in an already expensive region, underscoring the need for greater consumer protections and fiscal responsibility from local governments.

San Diego top stories

San Diego events

Feb. 18, 2026

Wild Kratts Live 2.0 - Activate Creature Power!Feb. 18, 2026

San Diego Gulls vs. San Jose BarracudaFeb. 18, 2026

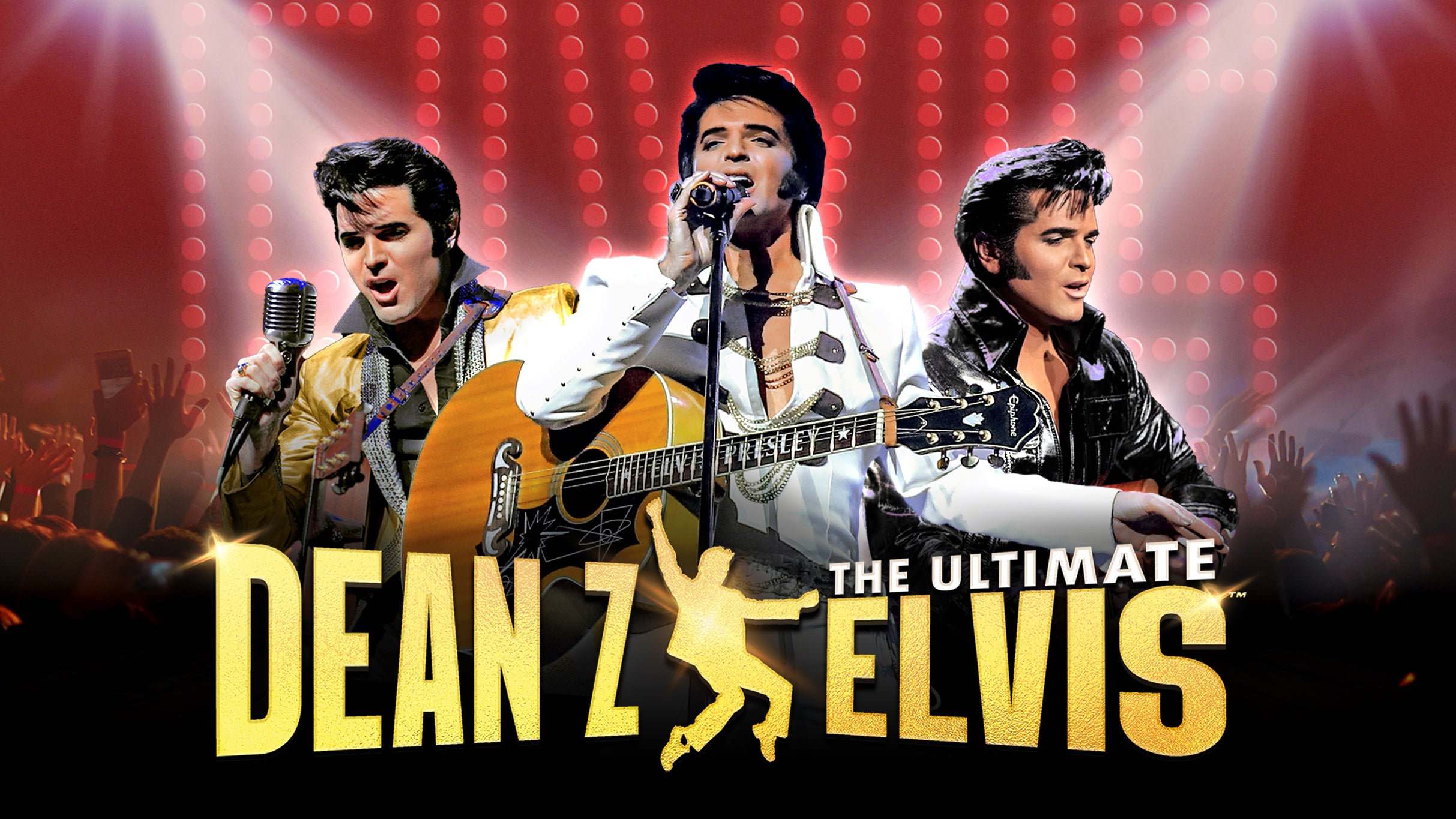

Dean Z: The Ultimate ELVIS