- Today

- Holidays

- Birthdays

- Reminders

- Cities

- Atlanta

- Austin

- Baltimore

- Berwyn

- Beverly Hills

- Birmingham

- Boston

- Brooklyn

- Buffalo

- Charlotte

- Chicago

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Denver

- Detroit

- Fort Worth

- Houston

- Indianapolis

- Knoxville

- Las Vegas

- Los Angeles

- Louisville

- Madison

- Memphis

- Miami

- Milwaukee

- Minneapolis

- Nashville

- New Orleans

- New York

- Omaha

- Orlando

- Philadelphia

- Phoenix

- Pittsburgh

- Portland

- Raleigh

- Richmond

- Rutherford

- Sacramento

- Salt Lake City

- San Antonio

- San Diego

- San Francisco

- San Jose

- Seattle

- Tampa

- Tucson

- Washington

Shareholder Lawsuit Filed Against REGENXBIO, Inc.

Robbins LLP informs investors of class action lawsuit over alleged misleading statements about drug candidate RGX-111.

Published on Feb. 17, 2026

Got story updates? Submit your updates here. ›

Robbins LLP has filed a class action lawsuit on behalf of investors who purchased REGENXBIO, Inc. (NASDAQ: RGNX) securities between February 9, 2022 and January 27, 2026. The lawsuit alleges that REGENXBIO misled investors about the viability of its drug candidate RGX-111, which was later placed on clinical hold by the FDA due to safety concerns.

Why it matters

REGENXBIO is a clinical-stage biotechnology company focused on gene therapies, and the RGX-111 drug candidate was one of its lead pipeline products. Allegations that the company misled investors about the safety and viability of this drug could have significant implications for the company's future and investor confidence.

The details

According to the complaint, REGENXBIO repeatedly touted RGX-111 as a promising drug candidate, highlighting positive interim data from clinical trials. However, the lawsuit alleges that the company was aware of serious safety issues, including the potential for central nervous system neoplasms. In November 2023, REGENXBIO abruptly decided to de-prioritize RGX-111 and seek 'strategic alternatives' for the program. On January 28, 2026, the company announced that the FDA had placed a clinical hold on RGX-111 and a related drug, RGX-121, due to the safety concerns.

- REGENXBIO announced RGX-111 had been granted Fast Track designation by the FDA in 2018.

- In November 2023, REGENXBIO decided to de-prioritize RGX-111.

- On January 28, 2026, REGENXBIO announced the FDA had placed a clinical hold on RGX-111 and RGX-121.

The players

REGENXBIO, Inc.

A clinical-stage biotechnology company providing gene therapies that deliver functional genes to cells with genetic defects in the United States.

Robbins LLP

A shareholder rights law firm that has filed a class action lawsuit against REGENXBIO on behalf of investors.

What’s next

Shareholders who wish to serve as lead plaintiff for the class must submit their papers to the court by April 14, 2026.

The takeaway

This case highlights the importance of biotechnology companies being transparent and accurate in their communications with investors, especially regarding the safety and viability of their drug candidates. Allegations of misleading statements could have serious consequences for the company and its shareholders.

San Diego top stories

San Diego events

Feb. 18, 2026

Wild Kratts Live 2.0 - Activate Creature Power!Feb. 18, 2026

San Diego Gulls vs. San Jose BarracudaFeb. 18, 2026

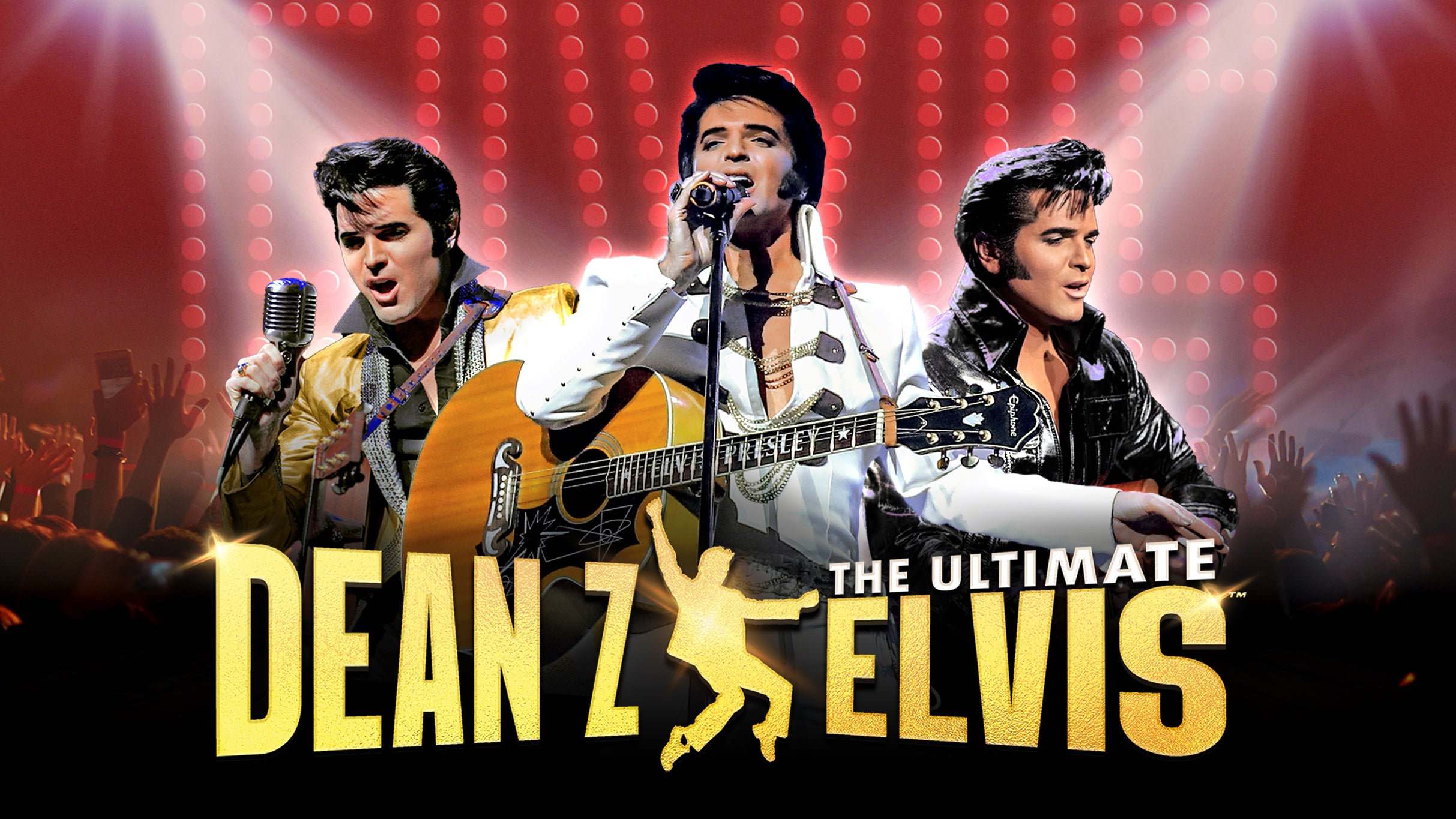

Dean Z: The Ultimate ELVIS